Claiming a Dependent

- October 13, 2021

- Posted by: CKH Group

- Categories: Financial Tips, Tax tips

Claiming a tax dependent can be a bit confusing, but that is why this article will break things down for you. First, it is important that we define what a tax dependent is: A tax dependent is a child or relative that meets a specific set of terms for eligibility to be claimed on your own taxes. Claiming a tax dependent allows you to claim certain tax deductions and credits, for example, the Child Tax Credit, certain tax deductions, and head of household filing status, among other benefits.

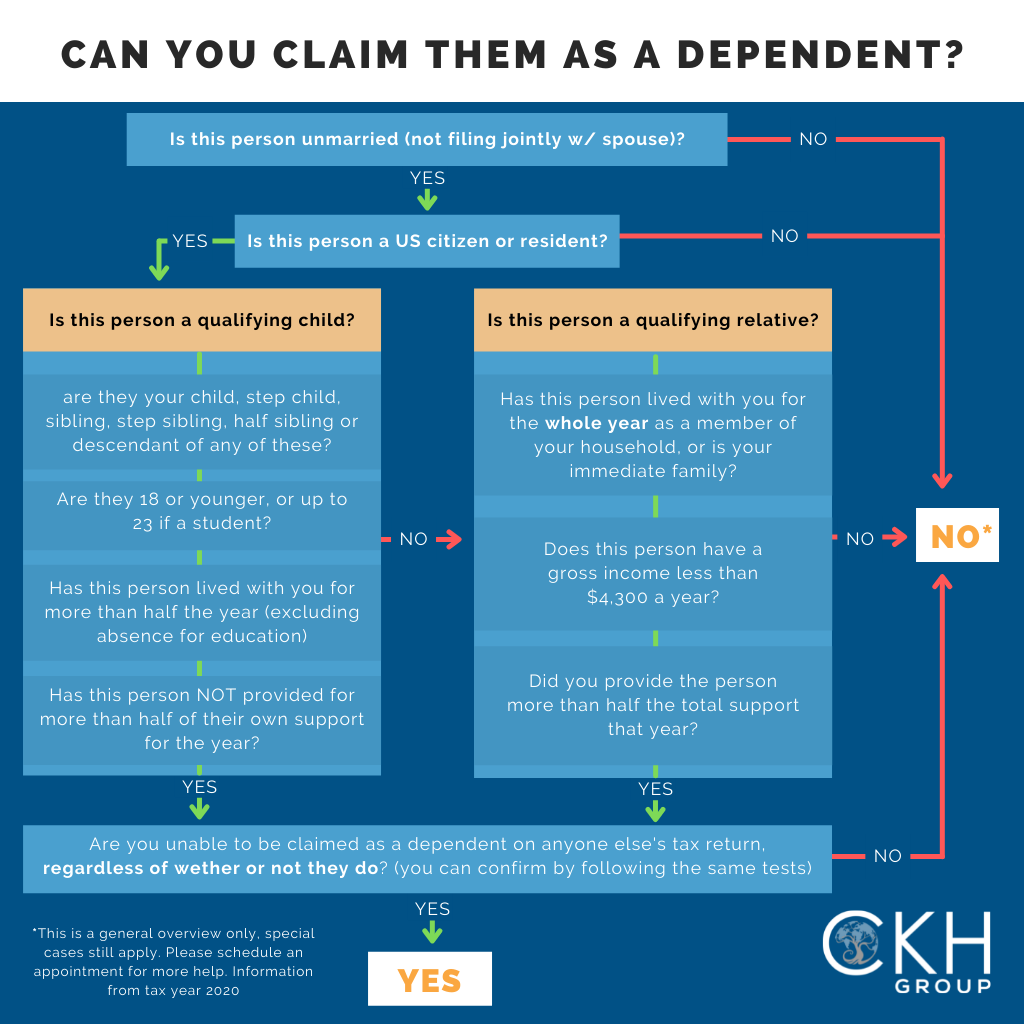

Checking if someone is eligible to be claimed as a dependent may seem like an overwhelming task, so this flowchart should help clear up any confusion.

Before you get into specifics you will need to determine if the person you want to claim is:

- A citizen or resident of the United States.

- Not claimed by someone else.

- Unmarried and not filing a joint return.

If the person you are trying to claim meets these requirements you can move on to thinking about how you relate to this person. If they are your child, stepchild, half-sibling, or a descendent of any of these then they fall under the category of a qualifying child.

If these terms of eligibility for qualifying child don’t apply then you can see if this person is a qualifying relative, instead.

Claiming a Qualifying Child:

To claim a qualifying child, they will need to meet these terms:

The child must be 18 or younger or a 23-year-old (maximum) full-time student attending school for 5 months out of the year.

They also must have lived in your home for more than half the year (excluding absences for education). In most cases of divorce or separation, the parent with custody may claim the child.

This person must also depend on you for more than half of their expenses.

Claiming a Qualifying Relative:

To claim a qualifying relative, they will need to meet these terms:

That is someone who has lived in your home for the whole year and is considered a member of your household, however they do not need to be directly related to you.

This person must also have a gross income that does not exceed $4,300.

And you must have provided for more than half of their expenses.

And most importantly, you should check if someone has claimed you as a dependent. If so, then you are ineligible for claiming a dependent of your own. There are more guidelines on who cannot be claimed as a dependent. For example, if the person you are trying to claim is not a US citizen, or they work for you, then they are not eligible to be claimed. For more details on claiming dependents reach out to CKH Group to book a free consultation.

The above article only intends to provide general financial information and is based on open source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personal tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm / errors / claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.