Understanding Clean Vehicle Tax Credits: Incentivizing Sustainable Transportation

- April 8, 2024

- Posted by: CKH Group

- Categories: Financial Tips, Tax tips

What are the 3 Clean Vehicle Tax Credits?

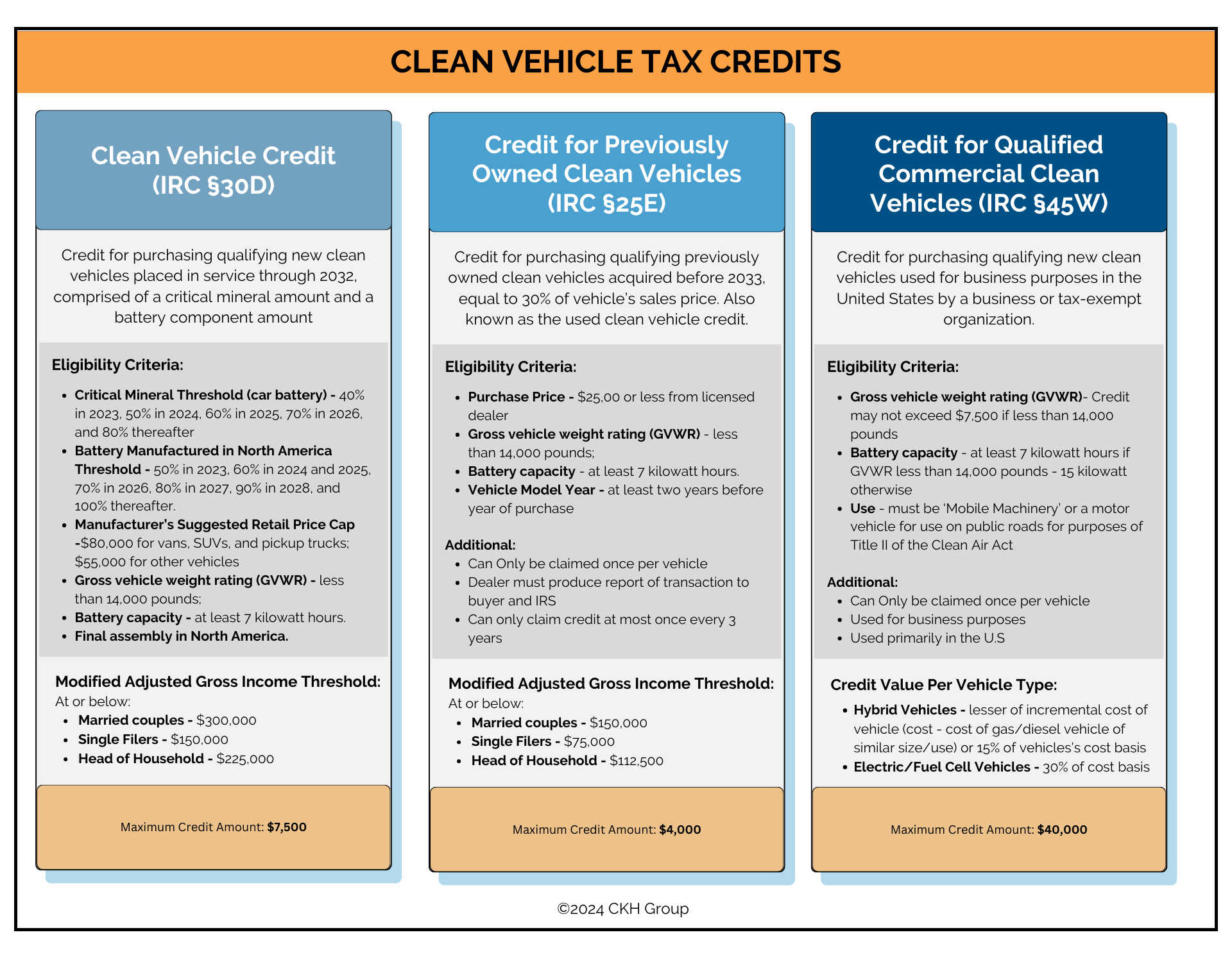

The federal government’s initiative to promote sustainability in transportation is facilitated through three clean vehicle tax credits aimed at reducing the purchase prices of electric, plug-in hybrid, and fuel cell vehicles. Enacted in the Energy Improvement and Extension Act of 2008, these credits underwent modifications through subsequent legislation, most notably the Inflation Reduction Act of 2023 (P.L. 117-169). Shown below is a brief overview of each of these credits.

This article explores each of these clean vehicle tax credits in-depth, shedding light on their intricacies and their impact on your taxes and economic policy.

This article explores each of these clean vehicle tax credits in-depth, shedding light on their intricacies and their impact on your taxes and economic policy.

Clean Vehicle Credit (IRC §30D)

Taxpayers purchasing qualifying new clean vehicles are eligible for a nonrefundable tax credit of up to $7,500 until the end of 2032. This credit comprises two components: the critical mineral amount and the battery component amount. To qualify for these components, certain thresholds regarding critical mineral sourcing and battery manufacturing in North America must be met. Additionally, vehicles must satisfy criteria such as MSRP caps, GVWR limits, and battery capacity requirements. Listed below are each of these requirements:

Eligibility Criteria:

- Critical Mineral Threshold (car battery) - 40% in 2023, 50% in 2024, 60% in 2025, 70% in 2026, and 80% thereafter

- Battery Manufactured in North America Threshold - 50% in 2023, 60% in 2024 and 2025, 70% in 2026, 80% in 2027, 90% in 2028, and 100% thereafter.

- Manufacturer’s Suggested Retail Price Cap –$80,000 for vans, SUVs, and pickup trucks; $55,000 for other vehicles

- Gross vehicle weight rating (GVWR) - less than 14,000 pounds;

- Battery capacity – at least 7 kilowatt hours.

- Final assembly in North America.

Modified Adjusted Gross Income Threshold:

At or below:

- Married couples - $300,000

- Single Filers - $150,000

- Head of Household - $225,000

It is also important to note that starting in 2024, taxpayers can transfer the credit to the vehicle dealer, making it effectively refundable. However, taxpayers exceeding MAGI limits after transferring the credit must repay it.

At CKH Group, we understand the importance of maximizing tax benefits for sustainable choices. Our expert advisors can guide you through the complexities of these eligibility requirements and help you leverage the Clean Vehicle Credit to its fullest potential, ensuring you receive the maximum benefits while contributing to a cleaner environment.

Credit for Previously Owned Clean Vehicles (IRC §25E)

This tax credit allows taxpayers purchasing qualifying used clean vehicles to claim a nonrefundable credit equal to 30% of the vehicle’s sales price, up to $4,000. Criteria for eligibility include purchase from a licensed dealer, specific price limits, GVWR ratings, battery capacity, and model year requirements. Similar to the clean vehicle credit, MAGI thresholds apply, and the credit can be transferred with repayment obligations for taxpayers exceeding income limits. Here is a list of these requirements:

Eligibility Criteria:

- Purchase Price - $25,000 or less from licensed dealer

- Gross vehicle weight rating (GVWR) - less than 14,000 pounds;

- Battery capacity - at least 7 kilowatt hours.

- Vehicle Model Year - at least two years before year of purchase

Additional:

- Can Only be claimed once per vehicle

- Dealer must produce report of transaction to buyer and IRS

- Can only claim credit at most once every 3 years

Modified Adjusted Gross Income Threshold:

At or below:

- Married couples - $150,000

- Single Filers - $75,000

- Head of Household - $112,500

Because these requirements are slightly different from those of new clean energy vehicles, reaching out to tax professionals like CKH Group can ensure you meet the above requirements and maximize your tax credit potential.

Credit for Qualified Commercial Clean Vehicles (IRC §45W)

Businesses and tax-exempt organizations purchasing qualified clean vehicles can also claim a tax credit of up to $40,000. The credit amount is different from those of individual taxpayers and varies based on the vehicle type and its incremental cost compared to traditional gas or diesel-powered vehicles. Here is a breakdown of the potential credit amount:

Credit Value Per Vehicle Type:

Hybrid Vehicles - lesser of incremental cost of vehicle (cost – cost of gas/diesel vehicle of similar size/use) or 15% of vehicles’ cost basis

Electric/Fuel Cell Vehicles - 30% of cost basis

Like the other credits, eligibility criteria include vehicle usage, battery capacity, manufacturer qualifications, and compliance with clean air regulations. Here is a list of those requirements:

Eligibility Criteria:

- Gross vehicle weight rating (GVWR)– Credit may not exceed $7,500 if less than 14,000 pounds

- Battery capacity - at least 7 kilowatt hours if GVWR less than 14,000 pounds – 15 kilowatts otherwise

- Use - must be ‘Mobile Machinery’ or a motor vehicle for use on public roads for purposes of Title II of the Clean Air Act

Additional:

- Can Only be claimed once per vehicle

- Used for business purposes

- Used primarily in the U.S

While nonrefundable, any unused credits can be carried back or forward to offset tax liabilities. For tax-exempt organizations, this credit can be received as a direct cash payment instead.

Cost and Distribution of Tax Credits

According to the Joint Committee on Taxation (JCT), these tax credits are estimated to reduce revenue by $34 billion over the FY2023-FY2027 period. Corporations and individuals claim a significant portion of these credits, with a disproportionate share historically going to high-income taxpayers. However, the introduction of refundable options and credit transfers aims to make the benefits more accessible to lower-income taxpayers.

Complementary Provisions

Federal tax policy includes provisions like the Alternative Fuel Vehicle Refueling Property Credit, which indirectly supports clean vehicle adoption by incentivizing the installation of infrastructure for clean-burning fuel or electric vehicle charging. Additionally, other tax incentives support clean hydrogen production and advanced manufacturing of battery components, further complementing the clean vehicle market.

In summary, the federal government’s clean vehicle tax credits play a crucial role in incentivizing sustainable transportation choices, though efforts to ensure equitable distribution and address broader environmental concerns remain ongoing.

At CKH Group, we’re dedicated to supporting your sustainability goals and maximizing your tax benefits. Contact us today to learn how we can assist you in navigating the complexities of clean vehicle tax credits and making informed financial decisions for a cleaner, greener future.

To learn more about what CKH Group can do for you, then reach out and let’s chat. You can book a free online consultation, or you can contact us at 1-770-495-9077 or email us at info@ckhgroup.com

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.