ACCOUNTS PAYABLE

(PROCURE TO PAY)

ACCOUNTS PAYABLE

(PROCURE TO PAY)

Reliable Accounts Payable Accountants

The Accounts Payable (AP) function plays a pivotal role in the financial ecosystem of any organization. Efficient management of the Procure to Pay (P2P) cycle is crucial for maintaining healthy cash flow, fostering vendor relationships, and ensuring compliance with regulatory standards. CKH Group’s Accounts Payable outsourcing solution is tailored to meet these challenges head-on, offering a comprehensive range of services that empower businesses to focus on their core competencies.

As a leading CPA firm based in Atlanta, we take pride in offering Business Process Outsourcing Services designed to:

- Give you access to the expertise of AP accountants

- Reduce risk or costly errors

- Provide cost-effective, timely, and efficient results

What Is Accounts Payable (Procure to Pay)?

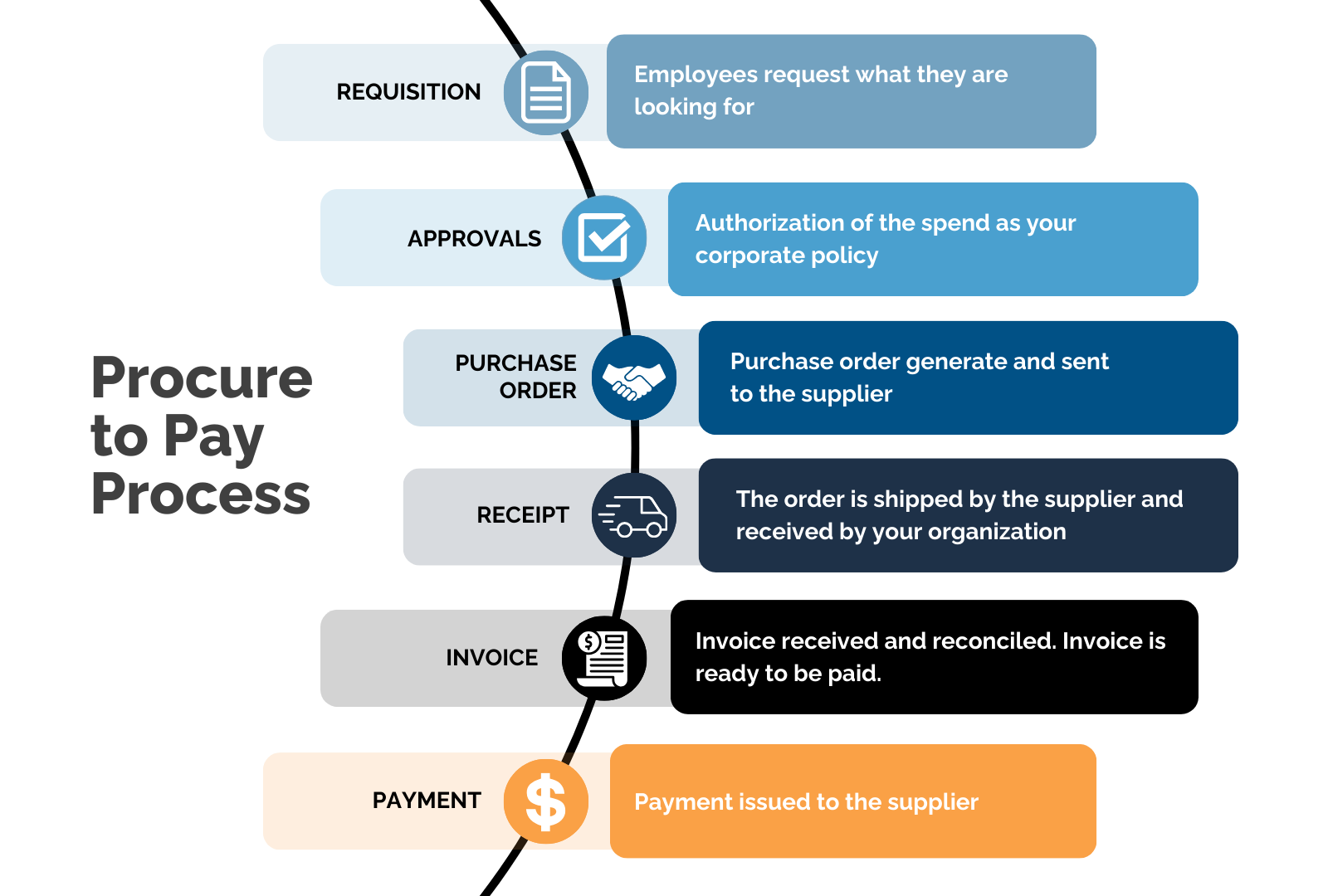

Accounts Payable (AP), also known as “payables,” denotes the short-term financial obligations that a company owes to its creditors or suppliers and has not settled. These outstanding payables are reflected on the company’s balance sheet as a current liability. This process of keeping track and reflecting payables in the balance sheet is a time intensive process handled by accountants, necessitating the outsourcing solution. This goes hand in hand with the procure to pay (P2P) cycle, which fully entails the events and actions that a business engages in when they require goods/services from a supplier.

Deliverables CKH Group Can Provide: Invoice Processing, Invoice Discrepancies, Vendor Queries, Process Payments, Period close, T&E Card admin, queries and report, T&E Expense processing, P Card admin and queries, and P Card Expense processing.

How to Record Accounts Payable

In order to record accounts payable, you must ensure proper double-entry bookkeeping. This involves maintaining a balanced system where each entry into the general ledger has a corresponding debit and credit. When recording accounts payable, the accountant credits the accounts payable upon receipt of the bill or invoice. Typically, the accompanying debit is directed to an expense account related to the goods or services purchased on credit.

Alternatively, if the acquisition involves a capitalizable asset, the debit may be assigned to an asset account. Subsequently, when settling the bill, the accountant debits accounts payable to reduce the liability, with the offsetting credit directed to the cash account, thereby decreasing the cash balance.

If this sounds like a tedious or confusing process, also consider companies may have multiple outstanding payments to vendors simultaneously, all of which are documented in accounts payable. CKH Group can save you time and effort while also mitigating risk by handling this process.

What is P2P?

P2P, or Procure to Pay, is a reference to the actions and processes taken by a business in regards to accounts payable. This includes sourcing, negotiating, requesting, ordering, receiving, and paying for purchases from your vendors. An Accounts Payable Accountant has functions that fall into this cycle, typically in regards to the invoicing step (crediting the accounts payable upon receipt of the invoice).

Why Choose CKH Group?

CKH Group’s Outsourcing Solutions are designed to support businesses where they need it most, empowering them to focus on their core competencies instead.

With CKH Group, you’re not just getting a CPA firm; you’re gaining a trusted partner committed to your success. Discover the CKH Group advantage, where excellence, integrity, and expertise come together to create a powerful outsourcing partnership for you. Contact us today to explore how our outsourcing services can add value to your organization.