ACCOUNTS RECEIVABLE

(ORDER TO CASH)

ACCOUNTS RECEIVABLE (ORDER TO CASH)

Accounts Receivable Accounting Services

Efficient management of the Accounts Receivable (Order to Cash) cycle is critical for any business aiming to maintain a healthy cash flow and sustain long-term growth. At CKH Group, we recognize the intricate dynamics of this process and the impact it has on your organization’s financial health. Our outsourcing solutions are a testament to our dedication to delivering unparalleled financial solutions that propel your business forward. Our accountants allow you to focus on your core competencies while we handle these complexities.

As a leading CPA firm based in Atlanta, we take pride in offering Business Process Outsourcing Services designed to:

- Give you access to quality talent and expertise

- Reduce risk or costly errors

- Provide cost-effective, timely, and efficient results

What Is Accounts Receivable (Order to Cash)?

Accounts receivable, commonly known as receivables, encompass the outstanding invoices or funds owed to a company by its clients for delivered goods or services. These receivables are recorded as assets on a company’s balance sheet, serving as a line of credit extended by the business. Recognized as liquid assets, they can be utilized as collateral for securing loans to meet short-term obligations, contributing to a company’s working capital.

The Services that CKH Group can provide include Master Data – Customer Credit, Cash Application, Collections Management, Deduction Management, Accounts Receivable Analysis, Period close, and Reconciliations.

Accounts Payable vs Accounts Receivable (AP vs AR)

These two business processes are direct opposites. As the name implies, AP are invoices that need to be paid to vendors, and AR are invoices that need to receive payment from customers. For example, if you are a bakery, the purchase of ingredients from vendors would be accounts payable, whereas the sale of a cake to a customer would be accounts receivable. Understanding and recording both in the General Ledger is crucial to the financial health of a company. Regardless of the business process, CKH Group is well equipped to handle outsourcing of both processes.

What is the Order to Cash Process (O2C process)?

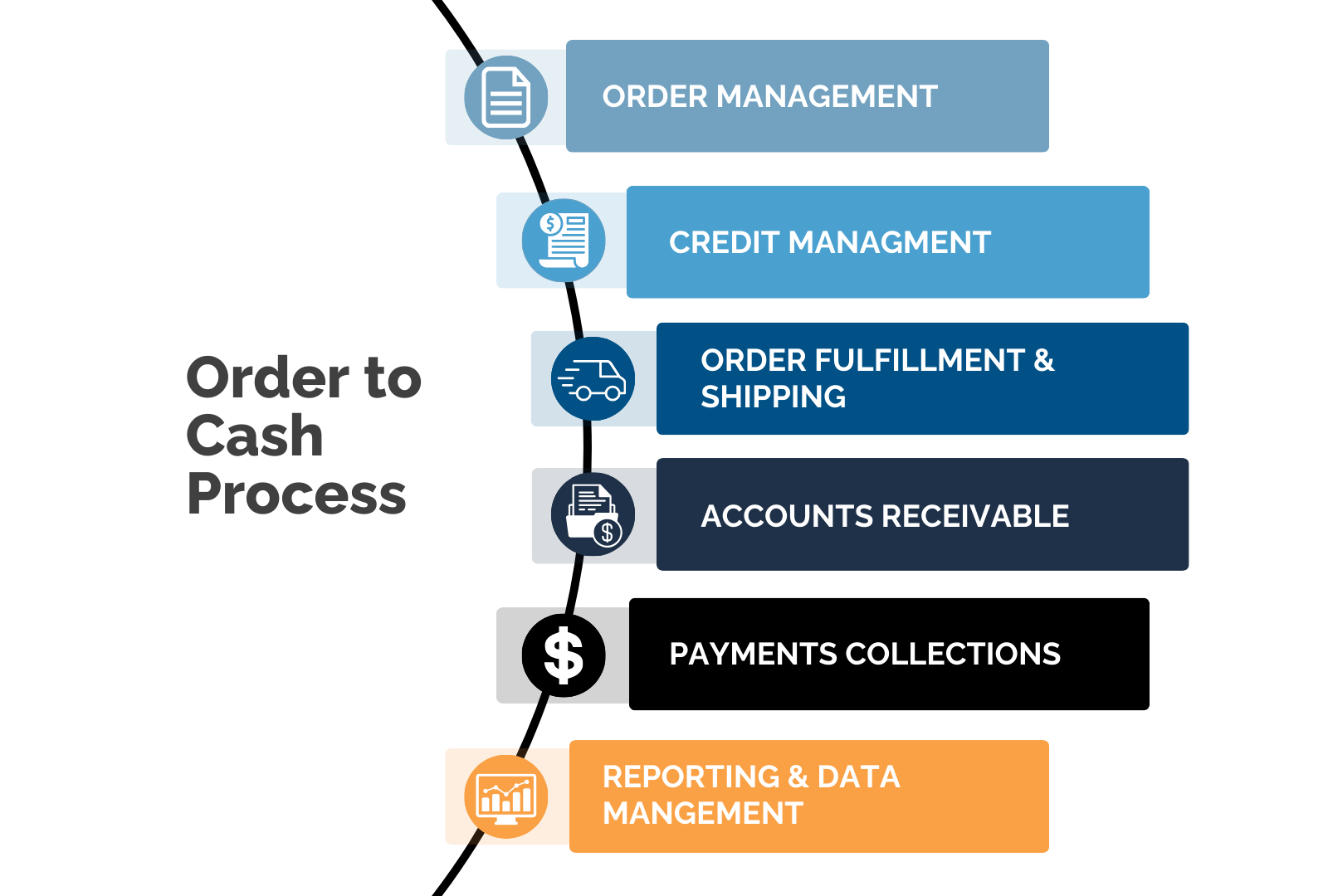

Order to Cash is a reference to the actions and processes taken by a business in regard to accounts receivable. This includes order management, credit management, order fulfillment and shipping, accounts receivable, payments collections, and reporting and data management. Each step is crucial to driving the relationship with a customer from acquisition to payment. This cycle also provides an opportunity to leverage each part of it, which is where CKH Group comes into play.

Why Choose CKH Group?

CKH Group’s Outsourcing Solutions are designed to support businesses where they need it most, empowering them to focus on their core competencies instead.

With CKH Group, you’re not just getting a CPA firm; you’re gaining a trusted partner committed to your success. Discover the CKH Group advantage, where excellence, integrity, and expertise come together to create a powerful outsourcing partnership for you. Contact us today to explore how our outsourcing services can add value to your organization.