IFRS, LOCAL, AND US GAAP CONVERSION

IFRS, LOCAL, AND US GAAP CONVERSION

Your Premier Partner in IFRS, Local, and US GAAP Conversions

At CKH Group, we understand that navigating the intricate landscape of International Financial Reporting Standards (IFRS), Local Generally Accepted Accounting Principles (GAAP), and US GAAP conversions can be a daunting task for businesses seeking to expand their global footprint. Our dedicated team of experts, with a deep understanding of these standards, is here to provide you with unparalleled outsourced solutions, performing these complicated conversions so you don’t have to.

As a leading CPA firm based in Atlanta, we take pride in offering Compliance Services designed to:

- Maintain global statutory compliance

- Reduce risk or costly errors

- Provide cost-effective, timely, and efficient results

What are IFRS, Local, and US GAAP Conversions?

International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), either in the US or your local country/government, are both important in an increasingly interconnected world. While these standards share fundamental concepts and frequently result in comparable accounting outcomes, there exist numerous distinctions in the specific accounting requirements. Consequently, directly comparing financial statements prepared under these different standards can pose challenges. Therefore, it is crucial for businesses with multiple global entities to convert one standard into the other.

Each country may have its own standards to follow, and this conversion is a time-intensive and specialized area of accounting that usually requires local understanding. CKH Group can leverage our global offices and MSI Global Alliance to ensure you receive support local to the country where you conduct business.

US GAAP vs IFRS

US GAAP (Generally Accepted Accounting Principals) and IFRS (International Financial Reporting Standards) are both accounting frameworks that must be followed in financial reporting. In the United States, the Financial Accounting Standards Board (FASB) dictates financial reporting practices, operating within the framework of generally accepted accounting principles (GAAP).

Conversely, International Financial Reporting Standards (IFRS) have been adopted by over 144 countries and constitutes a series of global accounting standards that specify how particular types of transactions and other events should be documented in financial statements. The main difference is that GAAP is rules-based, and IFRS is principles based (leaving more room for interpretation).

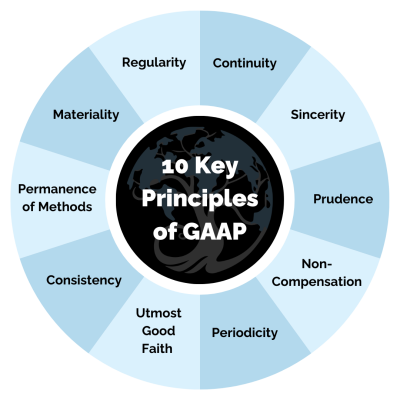

What are the US GAAP Principles?

At the heart of GAAP are ten principles intended to precisely outline, standardize, and govern the reporting of a company’s financial information. The primary goal is to ensure transparency, consistency, and the prevention of data manipulation or unethical practices.

Why Choose CKH Group?

CKH Group’s Outsourcing Solutions are designed to support businesses where they need it most, empowering them to focus on their core competencies instead.

With CKH Group, you’re not just getting a CPA firm; you’re gaining a trusted partner committed to your success. Discover the CKH Group advantage, where excellence, integrity, and expertise come together to create a powerful outsourcing partnership for you. Contact us today to explore how our outsourcing services can add value to your organization.