VAT COMPLIANCE

VAT COMPLIANCE

Simplified Value Added Tax Compliance

Value Added Tax (VAT) compliance is a critical aspect of financial management for businesses operating in a globalized economy. Our VAT Compliance service at CKH Group is tailored to meet the specific needs of your business. We diligently handle the complexities of VAT regulations, ensuring accurate reporting and timely submissions. Our experts are here to shoulder this area of statutory compliance, helping you avoid penalties and streamline your financial processes.

As a leading CPA firm based in Atlanta, we take pride in offering Compliance Services designed to:

- Maintain global tax compliance

- Reduce risk or costly errors

- Provide cost-effective, timely, and efficient results

What Is VAT Compliance (Value Added Tax)?

A Value-Added Tax (VAT) is a form of consumption tax imposed on the value added at each production stage of a product or service. In this system, every business involved in the value chain is eligible for a tax credit corresponding to the tax already paid. This distinguishes it from sales taxes, which are solely collected by the retailer at the point of final consumption. This system is typical in Europe and abroad, but not in the United States, which is why CKH Group offers support to US-based businesses with entities abroad who may not be familiar with the complexities of VAT compliance.

Is there Value Added Tax in USA?

No; VAT is not implemented in the United States. It is a popular form of indirect taxation in over 170 countries, and the US is the only developed country in the world that does not have this system in place.

Why doesn’t the US have a VAT system? The primary reason why VAT has not been adopted is because the US states have their own tax laws, tax rates, and exemptions. This makes it extremely difficult to mesh their different tax systems with a national VAT.

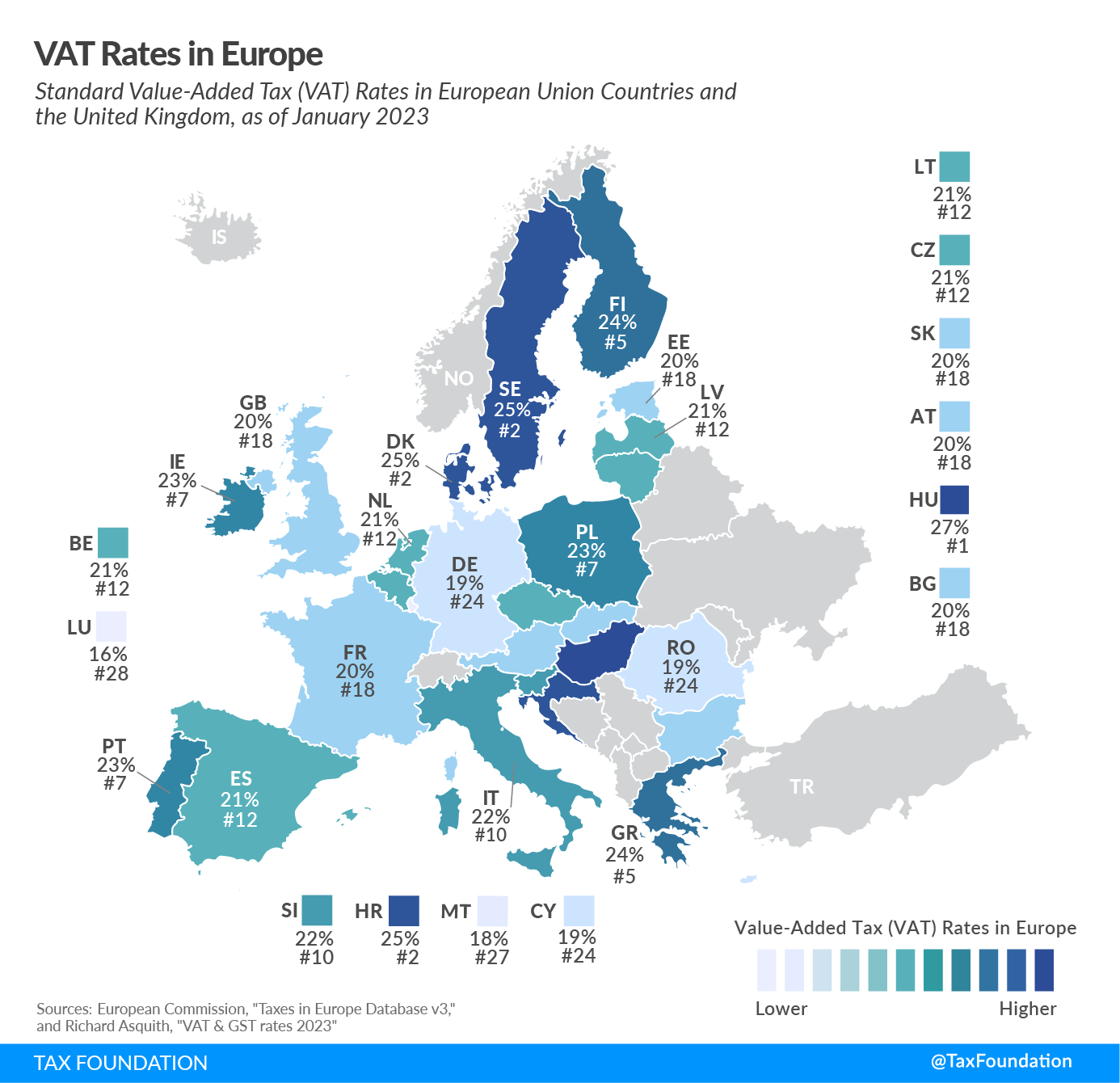

Value-Added Tax (VAT) Rates

The average global VAT rate is about 15%, ranging from around 12% – 20%. In the US, the average state and local sales tax rate is 6.44% as of 2023. We’ve provided an example of these rates in Europe, with credit to taxfoundation.org

Why Choose CKH Group?

CKH Group’s Outsourcing Solutions are designed to support businesses where they need it most, empowering them to focus on their core competencies instead.

With CKH Group, you’re not just getting a CPA firm; you’re gaining a trusted partner committed to your success. Discover the CKH Group advantage, where excellence, integrity, and expertise come together to create a powerful outsourcing partnership for you. Contact us today to explore how our outsourcing services can add value to your organization.