The Impact of Recent Developments in VAT Compliance

- June 10, 2024

- Posted by: CKH Group

- Categories: Current Events, Financial Tips

Navigating Recent and Future Developments in UK VAT Compliance

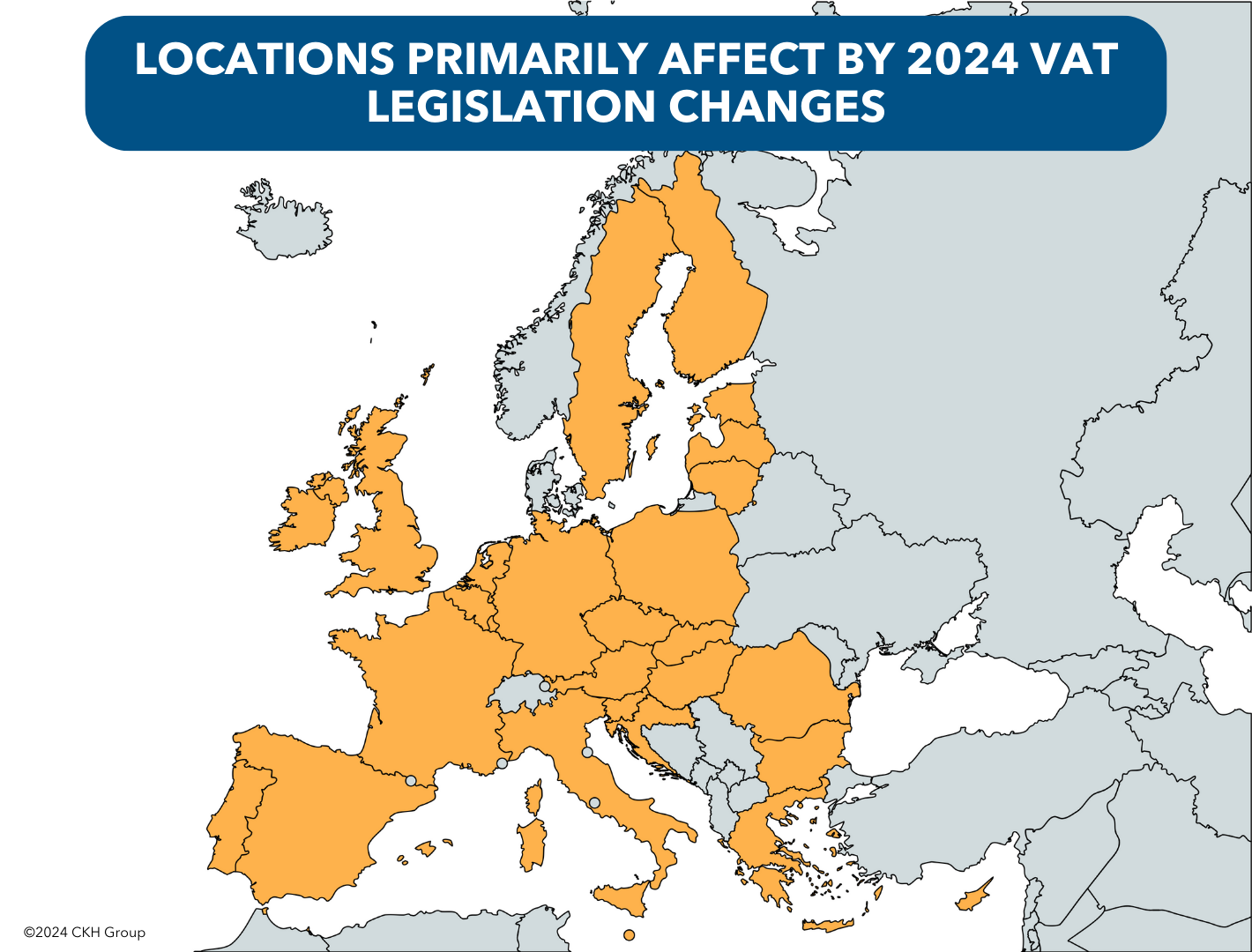

In the ever-evolving landscape of global commerce, staying ahead of legislative and policy changes is paramount for businesses, particularly in the realm of Value Added Tax (VAT) compliance. From January to May 2024, significant developments have occurred in the UK, with further changes slated for the remainder of the year and beyond. Understanding these developments and their implications is essential for businesses to ensure compliance and mitigate potential risks.

What is VAT?

Value Added Tax (VAT) is a consumption tax imposed on the value added at each stage of production or distribution of goods and services. Unlike traditional sales taxes, which are applied only at the point of sale to the final consumer, VAT is levied at multiple stages of the supply chain, from raw materials to the end product.

Businesses are typically required to register for VAT and charge it on their sales, while also reclaiming VAT paid on their purchases. This system ensures that tax is ultimately borne by the end consumer, but it also means that businesses play a crucial role in collecting and remitting VAT to the government. VAT rates and regulations vary between countries, making compliance a complex yet essential aspect of financial management for businesses operating globally.

Recent VAT Legislation and Policy Changes

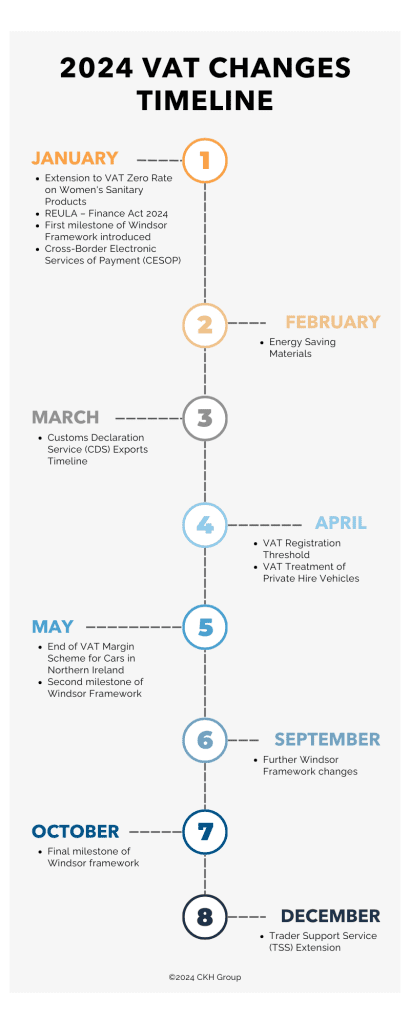

January 2024:

January 2024:

Extension to VAT Zero Rate on Women’s Sanitary Products:

In January 2024, the zero rate relief on women’s sanitary products was extended to include reusable period underwear, subject to specific qualifying criteria. This extension impacts manufacturers and retailers of reusable period underwear, particularly those in the hygiene and healthcare sectors.

REULA – Finance Act 2024:

The Retained EU Law (Revocation and Reform) Act 2023 (REULA) ended the supremacy and special status previously afforded to retained EU law, impacting the interpretation and application of VAT and excise laws in the UK. The repeal of the supremacy of retained EU law affects all businesses operating in the UK, particularly those involved in international trade and commerce.

First milestone of Windsor Framework introduced:

Beginning January 31st, significant changes were implemented regarding goods moving directly to Great Britain from Ireland, subjecting them to the full customs regime. Additionally, alterations to health certification requirements for medium-risk animal products, plants, plant products, and high-risk food and feed of non-animal origin from the EU were enforced. These changes signify the initial steps in establishing a comprehensive “green lane” between Great Britain and Northern Ireland, marking a significant milestone in cross-border trade facilitation.

Cross-Border Electronic Services of Payment (CESOP):

The introduction of CESOP, a new EU regulation effective from January 1st, 2024, mandates Payment Service Providers (PSPs) to report payment transactions where the payer is located within the EU and the payee is based in a second country, whether within or outside the EU. The first returns under this regulation are due by April 30th, 2024, highlighting the need for affected businesses to ensure compliance with reporting requirements.

February 2024:

Energy Saving Materials:

The government extended zero-rated relief for energy-saving materials to include battery storage, water-source heat pumps, and diverters retrofitted to ESMs, alongside specified necessary groundworks in heat pump installations. Manufacturers and suppliers of energy-saving materials, including battery storage and heat pumps, benefit from the extended relief.

March 2024:

Customs Declaration Service (CDS) Exports Timeline:

The Customs Declaration Service (CDS) is set to replace the Customs Handling of Import and Export Freight (CHIEF) system, with a scheduled rollout starting from June 4th, 2024, impacting export declarations. Exporters across various industries will need to adapt to the new Customs Declaration Service, ensuring compliance with export declaration requirements.

April 2024:

VAT Registration Threshold:

The government has declared its intention to raise the VAT registration threshold for the first time in seven years. The threshold will see an increase from £85,000 to £90,000, with the deregistration threshold also rising from £83,000 to £88,000. Small businesses approaching the VAT registration threshold will need to monitor their turnover to ensure timely registration.

VAT Treatment of Private Hire Vehicles:

An upcoming consultation was announced in April 2024 to address the impact of a High Court ruling on the VAT position of private hire vehicle operators. Operators of private hire vehicle services, particularly those utilizing agency arrangements, will need to review their VAT positions following the upcoming consultation.

May 2024:

End of VAT Margin Scheme for Cars in Northern Ireland:

Starting May 1st, 2024, motor vehicles sold in Northern Ireland can no longer utilize the VAT margin scheme, impacting the taxation of vehicle sales. Car dealers and importers in Northern Ireland will need to adjust their VAT accounting practices for vehicle sales.

Second milestone of Windsor Framework:

Additional customs checks and inspections will be introduced between Great Britain and Northern Ireland, affecting trade of medium-risk animal products, plants, and high-risk food and feed of non-animal origin from the EU. Businesses involved in the trade of animal products, plants, and food between Great Britain and Northern Ireland will face additional customs checks and inspections.

September 2024:

Further Windsor Framework changes:

A new system for parcel movement will be introduced to ensure consumers can send and receive parcels as they currently do. The “green lane” arrangements for freight movements will also apply to parcel consignments between businesses. Parcel delivery companies and businesses involved in cross-border trade between Great Britain and Northern Ireland will experience changes to parcel movement procedures.

October 2024:

Final milestone of Windsor framework:

Safety and Security declarations will be required for imports into Great Britain from the EU or other territories where the waiver applies. Additionally, there will be a reduced dataset required for imports, with the UK Single Trade Window aiming to eliminate duplication across pre-arrival datasets. Importers into Great Britain will need to comply with new safety and security declaration requirements, particularly those importing from the EU or territories where the waiver applies.

December 2024:

Trader Support Service (TSS) Extension:

HMRC has confirmed the extension of the Trader Support Service (TSS) until 31 December 2024, providing businesses with continued support in navigating customs procedures and VAT compliance. Businesses relying on the Trader Support Service for customs declarations and VAT compliance in Northern Ireland will benefit from the extension, but should plan for potential changes beyond 2024.

How CKH Group Can Help

Amidst these regulatory changes, businesses require expert guidance to navigate VAT compliance effectively. CKH Group, an Atlanta-based CPA firm, offers comprehensive assurance, tax, accounting, and advisory services tailored to meet global compliance needs. With strategic locations across the United States, Europe, and Africa, CKH Group is uniquely positioned to provide immediate and responsive support to international clients.

By leveraging CKH Group’s expertise and white-glove partnership approach, businesses can simplify compliance processes and uphold standards of trustworthy excellence. Whether it’s interpreting complex VAT legislation, optimizing compliance strategies, or preparing for regulatory changes, CKH Group empowers financial leaders with unparalleled support, tailored to local needs.

In conclusion, as businesses prepare for upcoming VAT compliance challenges, partnering with CKH Group ensures they navigate their financial landscapes with confidence, setting the stage for sustainable growth and success in a dynamic global marketplace.

To learn more about what CKH Group can do for you, reach out and let’s chat. You can book a free online consultation, or you can contact us at 1-770-495-9077 or email us at info@ckhgroup.com

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.

January 2024:

January 2024: