What is EBITDA?

- January 21, 2026

- Posted by: CKH Group

- Category: Financial Tips

What Is EBITDA and Why It Matters in Quality of Earnings

When assessing a company’s performance and durability of earnings, accountants and financial analysts rarely rely solely on net income or raw reported profits. With variance in industry, tax rates, and business structure, two companies that have the same net income could tell a wildly different story about the value of their company. Instead, one of the most common starting points for evaluating operational performance is EBITDA, or ‘Earnings Before Interest, Taxes, Depreciation, and Amortization’.

This article focuses on what EBITDA is, how to calculate, and how adjusted EBITDA is central to a quality of earnings report and M&A transactions. At its core, EBITDA strips away financial, tax, and non-cash accounting effects to focus on the earnings generated by the core business operations, offering a clearer picture of cash-based performance than net income alone.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. As the name implies, EBITDA shows how much money a business makes from its core operations before financing decisions, tax obligations, and non-cash accounting expenses are considered.

It is not the same as profit, nor is it cash in the bank. Instead, EBITDA is designed to isolate operating performance; how well the business itself is running day to day.

How EBITDA Is Calculated

To calculate EBITDA, we typically start with net income (the bottom line on the income statement) and then add back:

- Interest expenses – because this reflects how the business is financed, not how it operates

- Taxes – because tax rates vary by location, structure, and timing

- Depreciation and amortization – non-cash accounting charges related to past investments

These amounts are added back only to remove their impact from the final number. The goal is to answer one question: “What does this business earn from operations alone?”

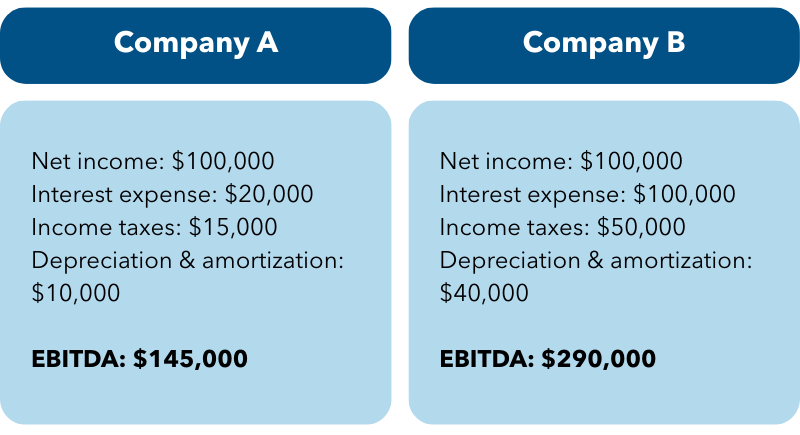

Let’s say two companies report the following:

While both have the same net income, which do you think makes more from their operations alone? Company A’s EBITDA is $145k, whereas Company B’s is $290k- which is double that. This means that before interest, taxes, depreciation, and amortization, it is clear that Company B’s performance is markedly better.

While both have the same net income, which do you think makes more from their operations alone? Company A’s EBITDA is $145k, whereas Company B’s is $290k- which is double that. This means that before interest, taxes, depreciation, and amortization, it is clear that Company B’s performance is markedly better.

Analytical frameworks often start with EBITDA precisely because it removes these distortions that can make performance vary dramatically from one company or industry to another. It levels the playing field for comparing businesses with different tax rates, capital structures, and asset intensity.

Why Adjusted EBITDA Is Central to Quality of Earnings

In the context of a Quality of Earnings (QoE) report, especially in mergers and acquisitions, the unadjusted EBITDA figure is considered only a starting point. What matters most to buyers, investors, and lenders is Adjusted EBITDA, which normalizes the earnings figure even more to reflect ongoing, recurring operational performance.

What is Adjusted EBITDA?

Adjusted EBITDA begins with the standard EBITDA figure and then eliminates or adds back items that obscure the company’s true earnings potential. These typically include common QoE adjustments such as:

- One-time or non-recurring expenses (e.g., litigation costs, restructuring charges)

- Non-operational income or expenses (income not related to the core business, such as selling a piece of equipment you use for your business)

- Owner or discretionary items (personal travel recorded as business expense, below-market related-party transactions)

- Accounting irregularities discovered during diligence.

The purpose of these adjustments is not to inflate results, but to normalize them: align reported earnings with the sustainable level of earnings a buyer can reasonably expect after a transaction closes. All of this is to pull back the curtain on figures that ‘look good on paper’ and reveal their true quality.

EBITDA vs. Adjusted EBITDA

While the textbook EBITDA figure provides a base measure of operational earnings, it still can reflect historical anomalies that don’t represent future cash flow. That’s where a QoE report inherently ramps up the analytical rigor:

- Standard EBITDA shows what happened.

- Adjusted EBITDA shows what is recurring and expected to continue.

Buyers often multiply this adjusted figure by industry-specific valuation multiples to determine enterprise value. Therefore, the accuracy of this adjusted figure directly influences valuation negotiations and the ultimate price a buyer is willing to pay. In larger transactions, the accuracy of this figure can mean the difference between thousands if not millions of dollars, which is why conducting a Quality of Earnings Report is so important.

How EBITDA Fits Into a Quality of Earnings Report

A properly executed QoE report uses EBITDA as a lens through which earnings quality and risk are assessed. The report will typically:

- Reconcile historical earnings: confirming that reported results adhere to GAAP before any adjustment.

- Identify and eliminate distortions: separating recurring operational earnings from extraordinary items.

- Standardize owners’ compensation and discretionary expenses: so EBITDA reflects the cost of replacing current management with market-rate equivalents.

- Benchmark operational performance: comparing normalized EBITDA to industry peers or historical trends to assess sustainability.

In essence, Adjusted EBITDA becomes the heart of the QoE analysis because it quantifies earnings in a way that aligns with expectations for future performance. It helps avoid buyer’s remorse, or suddenly plummeting profits because you didn’t have the insight to see a business’s true bottom line.

Practical Implications for Buyers and Sellers

For sellers, understanding how EBITDA will be viewed and adjusted in a QoE report can influence business decisions long before a transaction is proposed. Documenting legitimate recurring earnings and supporting non-recurring item adjustments with thorough documentation can materially affect valuation outcomes.

For buyers, scrutinizing adjusted EBITDA provides a measure of confidence in projections. When done correctly, this analysis helps identify potential risks, such as over-reported earnings or unsustainable expense structures, before capital is committed.

EBITDA, and particularly adjusted EBITDA, is a powerful economic indicator of operational performance. In a Quality of Earnings analysis, EBITDA’s true value is realized only after rigorous normalization to reflect recurring, sustainable earnings. Adjusted EBITDA becomes the benchmark buyers use to compare opportunities, negotiate price, and project future cash flows with confidence.

In the QoE process, EBITDA thus serves both as a foundational financial measure and a diagnostic tool that reveals not just how profitable a business has been, but how healthy and reliable its earnings truly are for the future.

If you have any questions about quality of earning, EBITDA, or are undergoing an M&A transaction, please feel free to contact us online to talk more about how we can assist you.

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.