ARTICLES

ARTICLES

- All

- Current Events

- Financial Tips

- Tax tips

Moving from QuickBooks to QuickBooks Online

Moving from Quickbooks to Quickbooks online is a smart next step for businesses, but it’s not as simple as a click of a button. This article breaks down the step by step process CKH Group performs for proven, seamless migration optimized to our client needs.

5 Key Takeaways from AICPA ENGAGE 2025

CKH Group attended AICPA ENGAGE 25, where 25 distinguished speakers conducted sessions about various industry relevant topics. This article breaks down our key takeaways from the several days of learning and connecting with other accountants and experts.

Using Data-Driven Tools to Improve Audit Quality

At CKH Group, our approach to auditing is rooted in expertise, informed by experience, and amplified by the right technology. That’s why we utilize platforms such as Caseware IDEA to improve audit accuracy by empowering our audit team with data-driven tools.

5 Crypto Tax Tips

CKH Group’s CEO Kate Kudrenko recently attended the XRP Las Vegas conference to immerse in the evolving world of cryptocurrency and blockchain technology. Here are five essential crypto tax tips takeaways from the event.

12 Time Management Tips for Small Business Owners

Time is one of the most precious resources for small business owners. Here are some practical time management tips for small business owners to make the most of their time, including strategies that CKH Group can support through tailored solutions.

The Importance of Cash Flow Statements

This article takes you through the importance of cash flow statements, including what they are, real world examples, how they are prepared, and even how to improve and monitor your cash flow for better business decisions.

Meet Kate Kudrenko: The New CEO of CKH Group

CKH Group is proud to introduce Kate Kudrenko as our new Group CEO! With a deep commitment to growth, innovation, and excellence, Kate steps into this role with a wealth of experience and a vision for the future of CKH Group.

Beware Fraudulent Tax Preparers: Find a Trusted Atlanta CPA Firm

Tax season is a critical time for individuals and businesses, but unfortunately, it also attracts fraudulent tax preparers looking to take advantage of unsuspecting taxpayers. A recent lawsuit filed by the Justice Department highlights the dangers.

Important 2025 Tax Dates

In the midst of tax season, keeping track of all the relevant 2025 tax dates and deadlines can be confusing. Refer to this quick guide to make sure you never miss an important deadline.

2025 Tax Brackets

Understanding the 2025 tax brackets is crucial for taxpayers. This comprehensive guide breaks down the IRS’s current Federal Income tax brackets, helping you navigate the complexities of tax filing.

Your 2025 Quality of Earnings Report Guide

This quality of earnings report guide delves into the intricacies of QoE reports, exploring their purpose, methodologies, and critical role in M&A transactions while showcasing how CKH Group’s expertise delivers valuable insights for its clients.

Transferable Clean Energy Investment Tax Credit Guide

This complete guide gives a thorough overview of transferable clean energy investment tax credits (ITCs) including what they are, their history, who can benefit from purchasing them, how to transfer them, risk mitigation strategies, and our role in this market outlook.

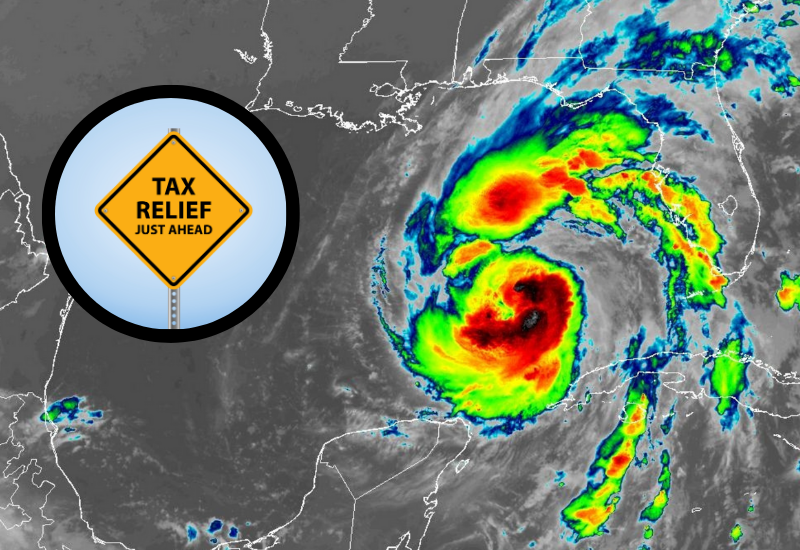

Hurricane Helene Tax Relief: Various Tax Deadlines Postponed

The IRS has announced Hurricane Helene Tax Relief for individual and business in Georgia and other disaster areas affected by Hurricane Helene. This relief is postponing various tax deadlines to May 1, 2025 as well as waiving certain fees and penalties.

Top 10 Financial and Tax Tips for Graduate Students

This guide outlines ten essential financial steps and tax tips for recent college grads to help you navigate post-graduation life with confidence and set yourself up for long-term success.

Top 10 Summer Tax Tips to Keep Your Finances Cool

Summertime may be a great time to unwind, but it also comes with its own challenges and expenses. Here are some financial and tax tips to keep your summer cool! This guide provides 10 simple tax tips to help you as you unwind.

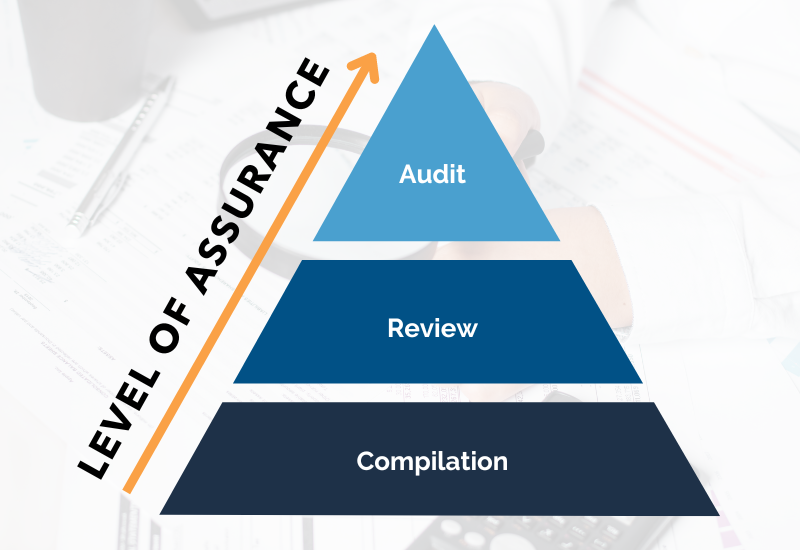

Audit vs. Review vs. Compilation: Simplified

Understanding the varying types of attestation services can benefit the growth and development of your organization. This guide breaks down the difference between audits, reviews, and compilation, so that you can make an informed decision.

The Impact of Recent Developments in VAT Compliance

Legislative changes in 2024 have affected VAT compliance, particularly in the UK. This article breaks down all the developments and future changes, including what types of businesses may be affected.

10-Step Guide to Mastering Payroll Processing

This complete guide details all the essential steps and strategies to streamlining your payroll operations and elevating your business’s success. Perfect for old and new business looking to understand the process from start to finish.

Understanding Clean Vehicle Tax Credits: Incentivizing Sustainable Transportation

This article explores each of the clean vehicle tax credits in-depth, shedding light on their intricacies and their impact on your taxes and economic policy.

Why You Should File a Tax Extension

Filing a tax extension is a strategic move that provides numerous advantages, contrary to some common misconceptions. With tax deadlines getting closer, we’ve compiled a guide for you as to what tax extensions are, the list of benefits for filing a tax extension, and how to file an extension, should you choose to.

Staying Vigilant: Employee Retention Credit Scams

On March 20th, the Internal Revenue Service (IRS) issued a press release warning taxpayers about the 2023 dirty dozen tax scams one of which is related to Employee Retention Credits (ERCs). This article details this scam and the ways to avoid it.

The 5 Pros of Outsourced Accounting

Outsourced accounting refers to the practice of hiring an external firm, like CKH Group, to handle a company’s financial and accounting operations. In this article, we discuss the benefits of outsourcing your accounting and finance functions.

Making the Most of Your Charitable Contributions

It is important to note that charitable contributions can only impact your tax bill if you choose to itemize your return. However, if you are doing so, this is a comprehensive guide to utilizing the Charitable Contributions tax deduction.

Everything You Need to Know About Student Loans

The Biden administration is furthering the pause on federal student loan payments, a program that began in March 2020 to help people who were struggling financially due to the impacts of Covid-19 pandemic.

The FTX Cryptocurrency Scandal

Only months ago, FTX, short for “Futures Exchange”, cryptocurrency was seemingly a huge success. Being valued at an estimated $32 billion in January and garnering massive support from celebrities. The platform was one of the biggest crypto trading exchanges and was recognized by the community as one of the more transparent crypto operations.

10 Helpful Small Business Tax Tips

Small Businesses can have tricky tax returns. Here are 10 helpful tax tips for small businesses.

Tax Terms Database

Tax Terminology can be hard to understand, but this guide will help you to learn what some of these tax terms mean.

Tax Guide to Cryptocurrency

The IRS now considers cryptocurrency to be property, and participating in crypto activities needs to be reported! Here is a guide to help you.

13 Common Tax Forms and What They are For

All of the IRS’s tax forms can be confusing. This small guide will help you understand some of the most used tax forms and what they are for.

Late Tax Filing: What To Do if You Miss a Tax Deadline

The deadline to file a tax return can sneak up on you. Worried about missing it? This article details the steps you can take prior to missing your deadline, and the actions you can take afterwards to mitigate some of the consequences.

Applying for a Federal Tax Extension

Tax deadlines seem to have a way of sneaking up on you, so filing for a tax extension might be something you need to do. If you need more time to prepare your return you can request a six-month filing extension by submitting the proper form to the Internal Revenue Service. Here is what you need to know!

Tax Preparation Guide

With tax season now in motion, it is smart to start planning for the April 15th deadline if you have not done so yet. This tax preparation guide is here to help you get prepared!

Non-refundable Tax Credits

Non-refundable Tax Credits can reduce your tax liability, but they come with specific limitations. In this article, we’ll dive deep into what non-refundable tax credits are, how they work, and the key points you should keep in mind when filing your taxes.

Refundable Tax Credits

A refundable tax credit can be applied to your tax bill and in some cases can generate a negative federal tax liability, meaning that your refundable tax credit can create a federal tax refund. This article explains refundable tax credits and how to utilize them.

Federal Tax Lien Vs Levy

There is often confusion about the difference between federal tax levies & liens. The terms “levy” and “lien” are not interchangeable, but they are closely linked. This article will break down everything you need to know about these important IRS penalties.

New 2022 Tax Brackets

On November 10th, 2021 the IRS announced their annual inflation adjustments to the 2022 federal income tax brackets. These adjustments impact more than 60 tax provisions. Here are the new numbers.

What You Need to Know About Tax Deductions

Tax deductions can help you save money— but only if you know what they are, how they work, and how to claim them. Here is a little guide to help you out.

Load Shedding in South Africa

In an attempt to prevent severe blackouts, Eskom, South Africa’s largest electric utility company, has initiated its process of “load shedding”. The idea of load shedding may be a confusing concept for some, but for the members of our South Africa office, this has become a regular occurrence in their daily lives. It is important to understand this process and how it affects South African citizens.

All About the Child and Dependent Care Credit

The Child and Dependent Care Credit is a helpful refundable tax credit that assists families in paying for childcare. The credit specifically offers relief to parents who pay for the care of a qualifying child while they work or search for work. The amount of eligible expenses that qualify for the credit varies depending on a taxpayer’s income level.

How to Avoid Tax Relief Scams

Engaging with companies like this could be a risky choice, if you owe taxes, but are unable to pay the IRS in full, there are a few legitimate IRS tax relief programs to help, through the agency’s Fresh Start initiative.

Claiming a Dependent

Claiming a dependent on your tax return can be a confusing process, but understanding the basics can unlock valuable tax benefits. This guide will help you understand what it means to claim a dependent and how to determine if someone qualifies as a dependent on your taxes.

Everything You Need to Know About the Vaccine Mandate

In 2024, while many vaccine mandates have been lifted, their past impact on businesses highlights the need for companies to remain informed, adaptable, and prepared for future public health directives.

Employee Retention Credit

The Employee Retention Credit (ERC) was put into place in March of 2020 under the CARES act as a temporary response to the impacts of the Coronavirus. This refundable tax credit was originally set to help companies keep employees on payroll.

Everything You Need to Know About the Child Tax Credit

What do the new advance child tax credit payments mean? Here is everything you need to know about what is changing, who is eligible, and how to receive the payments.

IRS Nonpayment Notices

Revenue Service has finally responded to a large number of complaints regarding incorrect unpaid tax notices. As a result, the mailing of three types of nonpayment notices have been suspended.

Why You Should Have a Trust Fund

As the tax season comes to a close, many look for ways to diversify their assets and plan their estate. A trust, or trust fund, is an estate planning tool that forms a legal entity to hold property or assets for a person or organization that is managed by a trustee.

Our articles are thoughtfully written and researched provided by the subject matter experts here at CKH Group. We aim to provide you with the latest industry updates, tips, guides, and resources to help you make more informed decisions for yourself or your business. You can also subscribe to our monthly newsletter to stay up to date on our newest releases.