10-Step Guide to Mastering Payroll Processing

- May 14, 2024

- Posted by: CKH Group

- Category: Financial Tips

Efficient Payroll Management with CKH Group: A 10-Step Strategy

Mastering payroll processing is not just about issuing paychecks; it’s about ensuring accuracy, compliance, and efficiency in every step of the process. In this comprehensive guide, we’ll walk you through ten essential steps or strategies to streamline your payroll operations and elevate your business to new heights of success. This guide is perfect for old or new businesses looking to understand payroll from start to finish or for businesses with a current payroll process looking to improve it.

Our 10-Step Guide at a glance is as follows:

-

- Understand the Applicable Payroll Laws and Regulations

- Understand Employer Obligations in Payroll Tax Compliance

- Designate a Payroll Manager and Payroll Policy

- Maintain an Accurate and Up-to-Date Employee Database

- Implement Efficient Time Tracking Systems

- Establish Consistent Pay Periods

- Explore Payment Options for Employee Compensation

- Avoid Common Mistakes in Payroll Processing

- Evaluate the Need for Outsourced Payroll Support

- Partner with CKH Group for Outsourced Payroll Processing

Step 1: Understand the Applicable Payroll Laws and Regulations

Before setting up any sort of policies, procedures, or software regarding payroll processing for your business, you must first understand the applicable laws and regulations specific to your organization. Depending on your location, number of employees, location of employees, and classification of employees, you could find yourself faced with a lot of legal hoops to jump through. CKH Group can help you understand the complexities of this process and take the guesswork out of it for you, but if you feel confident tackling this on your own, here are the items to keep in mind.

Payroll Laws and Regulations

Navigating the labyrinth of payroll laws and regulations can be daunting, but it’s crucial for maintaining compliance and avoiding costly penalties. Certain aspects of payroll processing are regulated by the Department of Labor (DOL), Department of Revenue (DOR), and the Internal Revenue Service (IRS). Familiarize yourself with federal, state, and local regulations governing payroll, including wage laws, tax requirements, and employee benefits.

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) regulates minimum wage, overtime pay, recordkeeping, and child labor standards for employees in the United States. Familiarize yourself with FLSA tax implications, exemptions, and compliance requirements to ensure fair and lawful employment practices. As a general tip, having accurate means of time tracking and keeping up-to-date records of employees will help employers avoid noncompliance.

Equal Pay Act

According to the Equal Pay Act, it is required that individuals performing the same tasks within a workplace receive identical compensation indiscriminate of gender. This encompasses various forms of remuneration, such as wages, bonuses, overtime pay, stock options, life insurance, and profit-sharing. This is why it is important to have an efficient payroll process, as it can help keep track of any discrepancies in pay and avoid civil lawsuits or other legal action.

State Payroll Laws and Regulations

Businesses must also keep in mind state-specific payroll laws. From minimum wage requirements to overtime regulations and payroll tax obligations, ensure that your payroll practices align with your state’s legal framework to avoid penalties and issues down the road.

Here are some key links to help ensure your state regulations:

State payday requirements

State minimum wage laws

All state labor laws

International Payroll Regulations

If your business operates internationally or hires remote workers from other countries, you’ll need to navigate the complexities of international payroll rules. Consider factors such as currency conversion, tax treaties, and compliance with local labor laws to ensure seamless payroll processing across borders. Here is a non-exhaustive list of some international regulations to keep in mind:

- Wages Protection System of the United Arab Emirates (UAE) – The WPS mandates that businesses in the UAE register with the Ministry of Human Resources and Emiratisation and pay employees through approved financial institutions by specified deadlines. Failure to comply may result in the denial of work permits.

- UK Employment Rights Act – The UK’s Employment Rights Act offers comprehensive guidance on various aspects of employment, including employment contracts, reasonable dismissal notices, unfair dismissal, parental leave, and redundancy.

- Labor Law of the People’s Republic of China – China’s Labor Law governs daily and weekly working hours, as well as provides guidelines on employment contracts, wages, labor disputes, working conditions, welfare, and overtime.

- European Union Working Time Directive (WTD) – The WTD, aimed at safeguarding employee health and safety, imposes restrictions on weekly working hours, including overtime, and establishes minimum standards for breaks and paid leave. Enforcement mechanisms may differ among member nations due to potential amendments by individual countries.

- German Act on Part-Time Work and Fixed-Term Contracts – This legislation in Germany provides guidelines for adjusting working hours during fixed-term employment agreements.

- Labor Standards Act of Japan – Japan’s Labor Standards Act, established in 1947 and subject to numerous amendments, addresses issues such as minimum wage, working hours, overtime, and annual leave.

The Cost of Non-Compliance

The consequences of non-compliance can be severe, ranging from hefty fines to legal disputes and reputational damage. Failing to pay employees on time, keeping incomplete payroll records, or filing payroll taxes incorrectly or late can all incur these consequences. This is why it is so important to stick to a payroll process or outsource to a company that can help mitigate these risks. Calculate the potential costs of non-compliance within your own business, including penalties, legal fees, and lost productivity, to underscore the importance of adherence to payroll regulations.

Step 2: Understand Employer Obligations in Payroll Tax Compliance

What is Payroll Tax?

Payroll taxes encompass various taxes withheld from employee wages and paid by employers to federal, state, and local tax authorities. As an employer, you are responsible for the calculation and withholding of this money. These amounts are determined by the W-4 form submitted by your employees (and current tax rates). There are also other obligatory taxes employers must consider, including FICA taxes and FUTA taxes.

Get an Employer Identification Number (EIN)

In order to maintain tax compliance, it is also crucial that your organization have an employer identification number, or EIN. It’s similar to a business’s ‘social security number’ and is used by the IRS to track tax compliance. It is free to apply for an EIN online, or by sending Form SS-4 to the IRS.

Federal Insurance Contributions Act (FICA) Taxes

Federal Insurance Contributions Act (FICA) Taxes

Federal Insurance Contributions Act (FICA) taxes fund Social Security and Medicare programs and are withheld from employees’ paychecks. Each pay period, employers must deduct 6.2% for Social Security tax (until the wage base is met) and 1.45% for Medicare tax. Employers are also required to match these deductions, which brings the total FICA tax per employee to 15.3%. Understand the intricacies of FICA tax calculation, wage limits, and reporting requirements to ensure compliance with federal tax laws.

Federal Unemployment Tax Act (FUTA) Taxes

The Federal Unemployment Tax Act (FUTA) imposes taxes on employers to fund unemployment benefits for workers who lose their jobs. FUTA is not a payroll deduction, but rather a tax employers pay in correlation to conducting payroll processing. To comply, you must pay 6% in taxes on the first $7,000 you pay an employee in a year, though some exemptions may apply.

Step 3: Designate a Payroll Manager and Payroll Policy

Designating someone responsible for payroll procedures is crucial for payroll to be processed timely and correctly. Even if a business outsources its payroll processes or utilizes payroll processing software, having someone ultimately responsible or as a point of contact to your outsourced provider will ensure you never miss a payment to your valued employees.

Some businesses will hire a payroll manager specifically for this function, but for small businesses or startups, this is usually managed by an office administrator, HR representative, or even the owner. As a result, they often have responsibilities outside of payroll processes. This is one of the main reasons payroll tasking is outsourced or streamlined using software, in order to free up time for the individual to focus on their other core responsibilities.

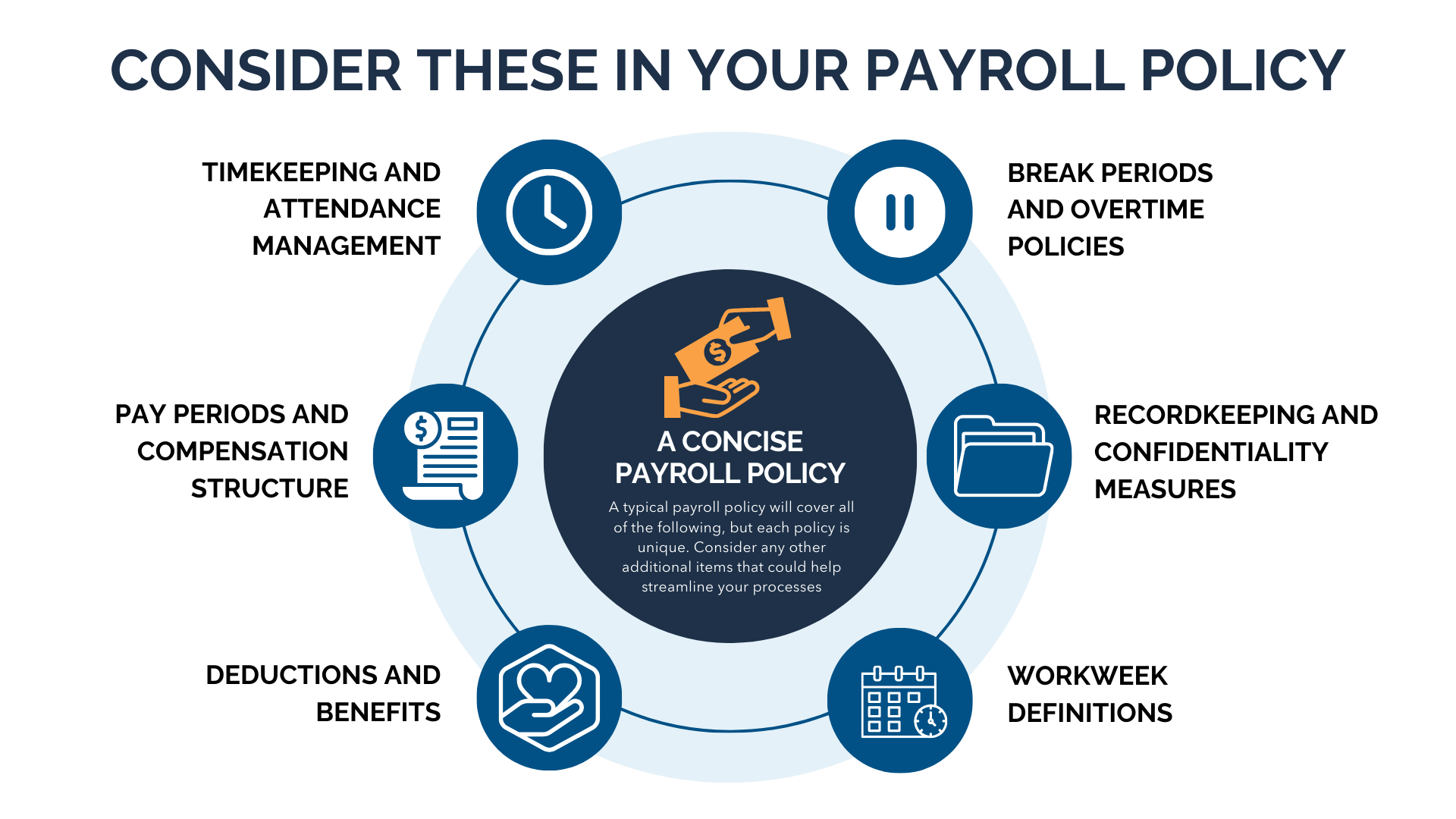

Crafting a Concise Payroll Policy

Once you have a payroll manager to facilitate the process, you must then empower your payroll manager with a clear and comprehensive payroll policy that outlines roles, responsibilities, and procedures.

A typical payroll policy will cover all of the following items:

- Timekeeping and Attendance Management – Accurate payroll starts with precise timekeeping methods. Establish clear guidelines for how employees should record their hours, whether through time clocks, digital platforms, or manual timesheets. Additionally, outline the approval process for time records and consequences for falsification.

- Pay Periods and Compensation Structure – Define the frequency of payroll cycles, whether weekly, biweekly, or semimonthly, and specify the payday. Clearly outline the different forms of compensation offered, such as hourly wages, salaries, bonuses, commissions, or stock options. Ensure compliance with state laws regarding final wage payments.

- Deductions and Benefits –Detail mandatory deductions for federal and state taxes, including instructions for completing relevant forms. Provide information on voluntary deductions for benefits like health insurance and retirement plans, along with the associated costs and enrollment procedures.

- Break Periods and Overtime Policies –Address the provision of rest periods and compliance with overtime regulations. Clarify eligibility criteria for overtime pay and outline the calculation of overtime rates in accordance with federal and state laws.

- Recordkeeping and Confidentiality Measures – Emphasize the importance of maintaining accurate payroll records to meet legal requirements. Specify record retention periods and confidentiality protocols to safeguard sensitive employee information.

- Workweek Definitions – Define the parameters of the workweek to align with overtime rules and wage payment regulations. Establish a consistent schedule comprising seven consecutive 24-hour periods.

Step 4: Maintain an Accurate and Up-to-Date Employee Database

Classifying Workers Correctly

Accurate classification of workers as employees or independent contractors is crucial for tax purposes and compliance with labor laws. Misclassifying workers can result in large penalties and you may be responsible for any unpaid wages, including overtime. Make sure you take some time to classify workers currently and fill out the appropriate tax forms to do so. If you need help determining the status of a worker, you can submit Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding to the IRS.

Compile Necessary Documents for Payroll Processing

Gather essential documents, such as W-4 forms, I-9 forms, and direct deposit authorizations, to facilitate payroll processing. Maintain organized records of employee information, tax withholding preferences, and employment eligibility verification to ensure accuracy and compliance. Here is a list of documents along with your business’s EIN, that you will likely need in order to begin payroll processing:

- Form W-4, Employee’s Withholding Certificate

- Form W-9, Request for Taxpayer Identification Number and Certification

- Form I-9, Employment Eligibility Verification

- Job application

- Bank information

- Photo ID

- Medical insurance forms

- Retirement plan documents

Create a Checklist for Onboarding Employees

Streamline the onboarding process and help with accurate employee recordkeeping by developing a comprehensive checklist that guides new employees through the necessary paperwork and procedures. Include tasks such as completing tax forms, setting up direct deposit, and enrolling in benefits to expedite the onboarding process and minimize errors.

Step 5: Implement Efficient Time Tracking Systems

Having an efficient time tracking system in place is critical in order to pay employees on time and accurately. This can minimize errors and save time for the payroll administrator. The easier and more streamlined it is for employees to enter their time; the more time is saved when processing these hours for payroll purposes.

Embracing Digital Software Solutions

Implementing Digital time-tracking systems can significantly streamline the process and enhance accuracy. Manual time-tracking methods like using pencil and paper are prone to human error, leading to inaccuracies in employee hours worked. These errors can result in overpaying or underpaying employees, leading to dissatisfaction and potential legal issues. By employing automated time-tracking solutions, such as mobile apps or integrated systems, the likelihood of errors is significantly reduced. Explore time tracking platforms that offer features such as clock-in/clock-out functionality, mobile accessibility, and integration with payroll systems for seamless data transfer.

Step 6: Establish Consistent Pay Periods

As part of your payroll policy, you will need to determine pay periods. This is also an important step if you intend to outsource payroll services. This is because most software or accountants will bill based on your pay period. It is important to take this time to define a standardized payroll cycle that aligns with your business’s operational needs and cash flow requirements. The typical pay periods are weekly, bi-weekly, or monthly.

Adhering to State Payroll Schedule Requirements

Some states have specific payroll schedule requirements, requiring you to pay at a certain minimum frequency or requirement for wage payments and filing payroll reports. Stay informed about changes to state labor laws and adjust your payroll schedule accordingly to avoid penalties for non-compliance.

Georgia Payroll Laws

CKH Group is headquartered in Atlanta, Georgia, so for our Georgia clients it is important to know that Georgia law requires employers to pay employees at least twice a month on regular paydays. These paydays should divide the month’s salary into at least two equal pay periods. Several other states also follow this law.

Optimizing Cash Flow Through Payroll

Optimize cash flow management by strategically timing payroll disbursements to coincide with revenue inflows and expense obligations. Consider factors such as billing cycles, payment terms, and seasonal fluctuations to ensure sufficient funds for payroll and other operational expenses.

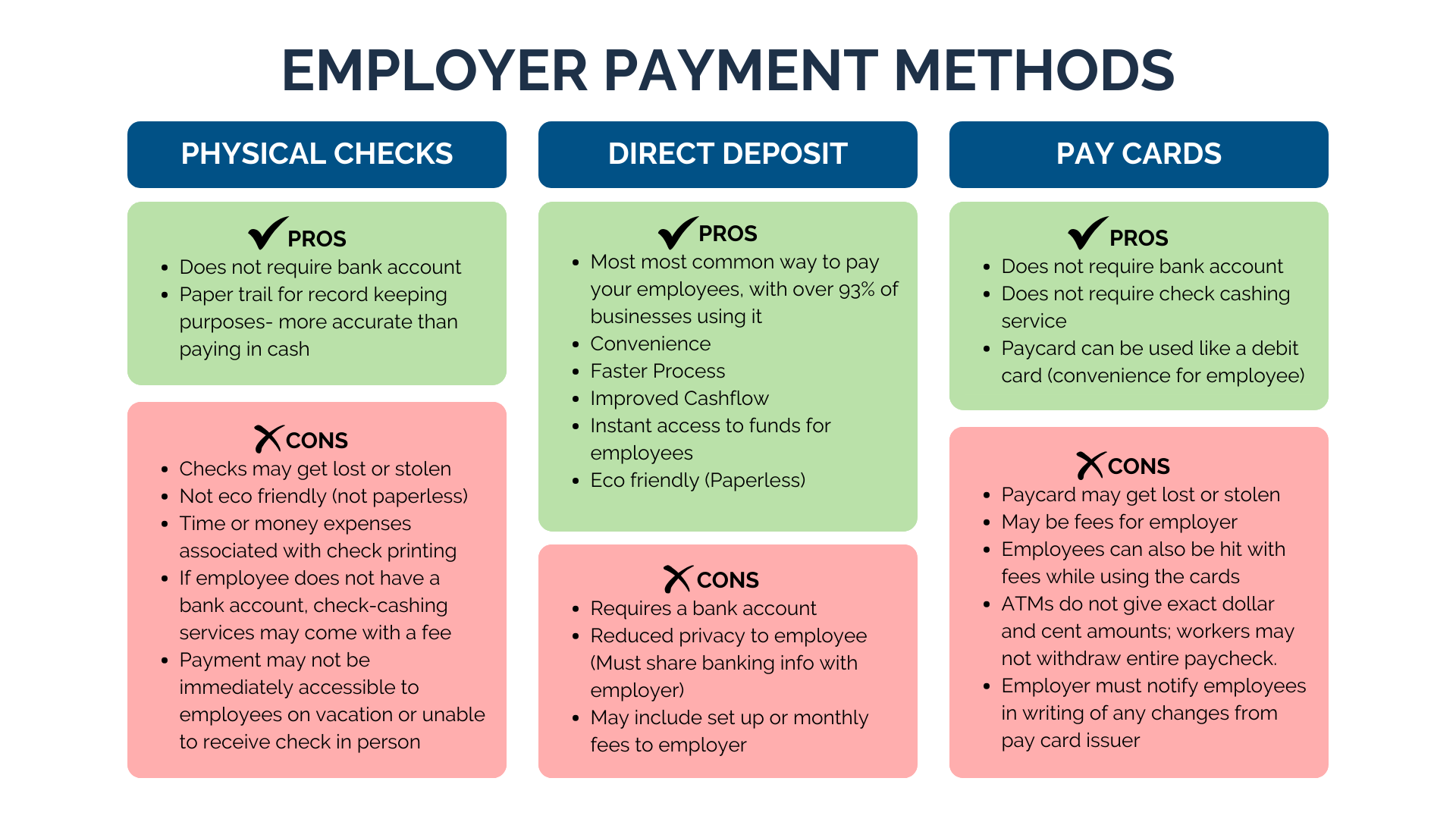

Step 7: Explore Payment Options for Employee Compensation

Evaluate different payment methods, such as direct deposit, pay cards, and traditional checks, to determine the most suitable option for your employees and business operations. Consider factors such as convenience, cost-effectiveness, and employee preferences when choosing a payment method.

Direct deposit, for example, is widely accepted and used due to its convenience for employees and employers alike, improving consistent cash flow and reducing paper consumption costs. Direct deposit is helpful to cash flow because it takes away any guesswork of when staff may cash physical checks; you know exactly how much money is being disbursed and at what time. However, some staff may prefer having physical checks, while others may not have bank accounts to direct deposit into, necessitating a different payment solution, like pay cards.

Step 8: Avoid Common Mistakes in Payroll Processing

Now that you’ve fully set up your process it’s important to keep in mind some of the common pitfalls that occur during payroll processing. Each of these errors can cause a headache at best and massive fines, audits, or legal intervention at worse.

Employee Misclassification

As mentioned before, ensure proper classification of employees as exempt or non-exempt and employees vs. independent contractors to avoid misclassification penalties and legal disputes. Familiarize yourself with classification criteria and consult legal counsel if unsure about an employee’s status.

Payroll Calculation Errors

Payroll calculations can be a very common error, even with efficient processes in place. To avoid this, double-check payroll calculations for accuracy and completeness to avoid underpayments, overpayments, and compliance issues. Implement checks and balances, such as reviewing timesheets and cross-referencing pay rates, to minimize errors and ensure fair compensation for employees.

Inaccurately Tracking Hours and Overtime

Implement robust time tracking systems to accurately record employee hours worked and calculate overtime pay. Monitor employee schedules, breaks, and time-off requests to ensure compliance with wage and hour laws and prevent disputes over unpaid wages or overtime.

Incomplete and Disorganized Records

Keep meticulous records of payroll transactions, employee data, and tax filings to facilitate compliance audits and inquiries. Establish filing systems and document retention policies to ensure accessibility, accuracy, and confidentiality of payroll records.

Missing Deadlines for Tax Deposits and Filings

Adhere to deadlines for payroll tax deposits, wage reporting, and filing tax returns to avoid late penalties and interest charges. Maintain a calendar of key tax deadlines and set reminders to ensure timely submission of payroll-related documents to tax authorities.

Not reporting All Taxable Employee Compensation

Ensure accurate reporting of all taxable employee compensation, including wages, bonuses, commissions, and fringe benefits. Familiarize yourself with IRS reporting requirements and forms, such as Form W-2 and Form 1099, to avoid penalties for incomplete or inaccurate reporting.

Step 9: Evaluate the Need for Outsourced Support

Startups and small business sometimes conduct their own payroll processing, as a lot of times, it may only be one or two employees. In this case, a lot of the stressors might be manageable by someone with a detail-oriented or accounting background. However, the more employees you have, the more complex your employee benefit plan, and the more varied your classification of employees, the harder it becomes to maintain effective and accurate payroll processing in-house. In addition, even the smallest of businesses may prefer the ease of outsourcing this process to someone who can reduce the risk of errors.

Assessing the Cost of Payroll Errors

If the lack of time, resources, or expertise in your payroll process is leading to payroll errors, it may be time to consider gaining additional outsourced support. Evaluate the financial impact of the risk of payroll errors, including penalties, fines, and reputational damage, to determine the cost-effectiveness of outsourcing payroll processing. Consider the potential savings in time, resources, and compliance risk mitigation offered by professional payroll services. If you’d like to know CKH Group’s payroll service rates, contact us to schedule a consultation to receive a quote.

Quantifying Time Spent on Payroll Tasks

One of the biggest benefits of outsourcing payroll processing is that it gives your business more time to focus on its core competencies rather than administrative aspects. Calculate the time and resources allocated to payroll processing tasks, including data entry, calculations, and reporting, to assess the efficiency of in-house payroll management. Compare the costs of internal payroll administration versus outsourcing to identify potential cost savings and productivity gains.

Addressing Employee Dissatisfaction with Payroll Processes

Not paying an employee on time can result in a huge stress on not just the employee but on the company. Repeated missteps can lead to employee dissatisfaction and higher turnover rates. In addition, if your payroll process is arduous, inaccurate, inaccessible, or not timely to those that use it, it can decrease productivity and increase stress. Identify pain points and areas for improvement that may be aided by outsourcing your payroll processing.

Step 10: Partner with CKH Group for Outsourced Payroll Processing

One of the easiest ways to streamline your payroll processing is to have a trusted accountant like CKH Group do it for you. Skip all the hassle and compliance worries by entrusting your payroll processing with CKH Group. Benefit from our team of experienced payroll specialists who leverage advanced technology and industry best practices to deliver accurate and timely payroll services.

Access 24/7 Support for Peace of Mind

Enjoy peace of mind knowing that CKH Group provides round-the-clock support for all your payroll inquiries and concerns. Our dedicated team is available to address your questions, resolve issues, and provide personalized assistance whenever you need it, ensuring uninterrupted payroll operations.

Same-Day Processing for Expedited Payments

Experience the convenience of same-day processing with CKH Group, allowing you to expedite payments to your employees and vendors. Our streamlined payroll processing ensures timely disbursement of funds, enhancing cash flow management and improving stakeholder satisfaction.

By following this comprehensive guide and leveraging the expertise of CKH Group, you can master payroll processing, ensure compliance, and unlock new levels of efficiency and accuracy in your business operations. Partner with us today to experience the benefits of professional payroll management and take your business to the next level.

To learn more about what CKH Group can do for you, reach out and let’s chat. You can book a free online consultation, or you can contact us at 1-770-495-9077 or email us at [email protected]

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.

Federal Insurance Contributions Act (FICA) Taxes

Federal Insurance Contributions Act (FICA) Taxes