Audit Readiness: A Marathon, Not a Sprint

- July 22, 2025

- Posted by: CKH Group

- Category: Government Accounting

A Year-Round Approach to Audit Readiness for Georgia Municipalities

Originally Published in GGFOA’s 2025 Summer Newsletter

Audit readiness is often misunderstood as a year-end scramble to gather reports and reconcile accounts. But in truth, it’s much more than that; it’s a year-round discipline that demands planning, attention to detail, and strong internal controls.

For cities and counties across Georgia, having audited financials each year is critical to being eligible for certain grants and funding, making it a key task year-after-year. Being audit-ready is about maintaining the integrity of public funds, ensuring compliance with laws and regulations, and upholding the trust of citizens.

“Audit readiness is not just a finance function—it’s the cornerstone of public accountability,” says Kerosha Reddy, Auditor at CKH Group.

This article offers an auditor’s look behind the curtain, providing insight from CKH Group, an Atlanta CPA firm with hundreds of hours in government audits in Georgia.

Understanding the Phases of a Government Audit

A typical government audit includes three main phases:

-

- Planning – Auditors review prior-year reports, assess risk, and request preliminary documents.

- Fieldwork – This is the intensive review phase where auditors analyze records, test internal controls, and verify account balances.

- Reporting – After the fieldwork, auditors issue findings, financial opinions, and management letters.

Each phase requires cooperation and preparedness from the municipality’s finance team. With proper audit readiness, the process can run efficiently, minimize disruptions, and lead to better outcomes.

What is Audit Readiness – Why Does It Matter?

Audit readiness means having your financial house in order: records are complete, accounts are reconciled, systems are up to date, and documentation is clear and accessible. But it also means your government is prepared to demonstrate compliance with Generally Accepted Accounting Principles (GAAP), Governmental Accounting Standards Board (GASB), Yellow Book requirements and state laws such as those outlined in the Official Code of Georgia Annotated (O.C.G.A.).

Failing to prepare can come with serious consequences: audit delays, qualified audit opinions, compliance issues, reputational harm, and in some cases, the loss of state or federal grant funding.

“When documentation is incomplete or disorganized, the audit timeline stretches, and so does the risk exposure,” Kerosha adds.

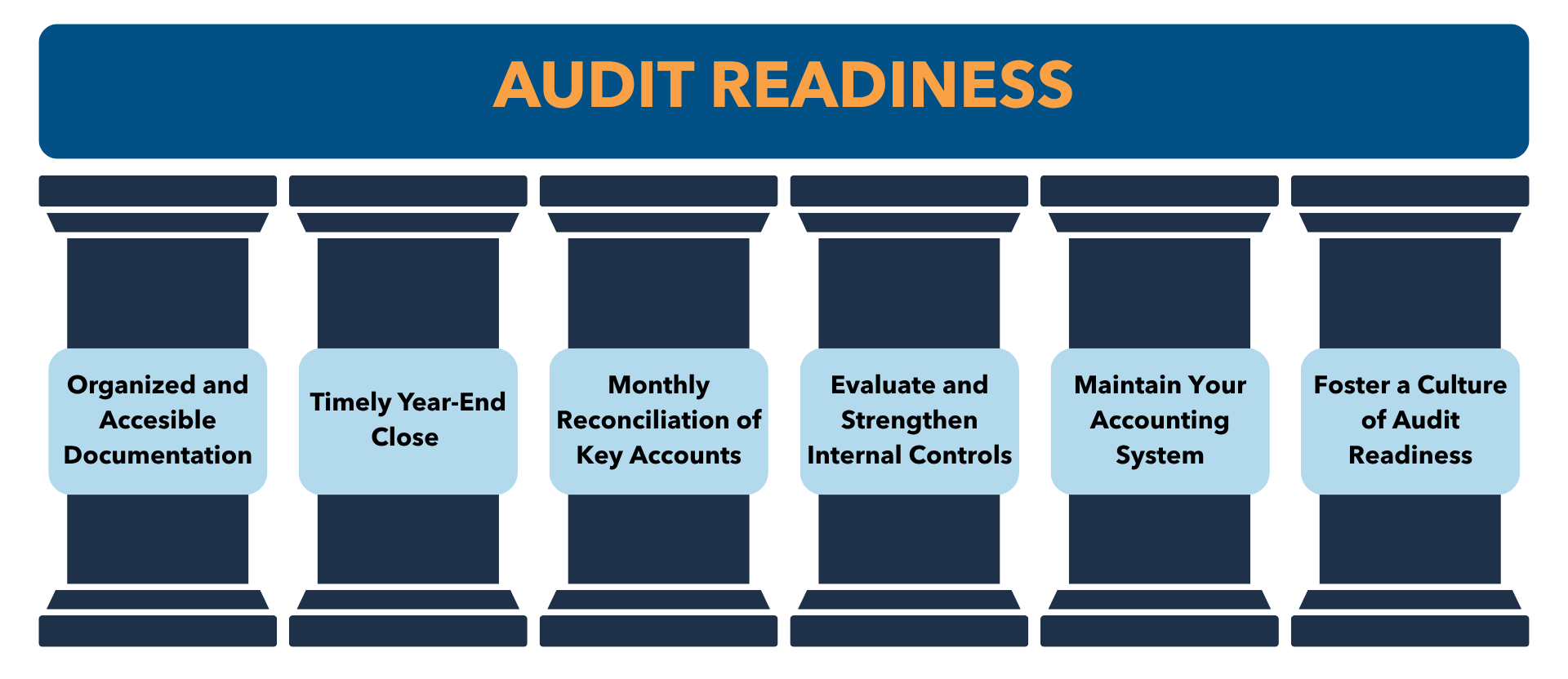

6 Key Pillars of Audit Readiness for Georgia Municipalities

1. Organized and Accessible Documentation

1. Organized and Accessible Documentation

Clear documentation is the foundation of a successful audit. Municipalities should:

-

- File invoices, contracts, tax reports, and budgets in a secure shared drive.

- Organize documents by fiscal year and fund type.

- Label files consistently and maintain schedules for all major balance sheet accounts like capital assets, debt, grants, and funding.

“If your team can’t find it quickly, neither can the auditors. Good documentation saves time and avoids red flags.”

2. Timely Year-End Close

Entities with a June 30 fiscal year should aim to close their books by September 30 at the latest. At this time:

-

- Journal entries must be reviewed and posted by internal deadlines.

- Inter-fund and interdepartmental balances must be reconciled.

- Cut-off procedures should be in place to ensure correct period recognition.

- Year-end accruals must be processed promptly.

Timely closing not only reduces audit delays but improves the accuracy of financial reporting across the board.

3. Monthly Reconciliation of Key Accounts

Regular reconciliation (verifying financial record balances against supporting documents) ensures errors are caught early and helps prevent large year-end corrections.

Key municipal accounts to reconcile monthly:

-

- Bank accounts

- Grants and subsidies received

- Revenue and accounts receivable

- Capital projects and accounts payable

4. Evaluate and Strengthen Internal Controls

Strong internal controls help prevent fraud, errors, and inefficiencies. Consider:

-

- Documenting finance-related policies and procedures.

- Ensuring segregation of duties in critical areas.

- Reviewing journal entries and budget amendments.

- Performing internal financial reviews throughout the year.

- Restricting system access and conducting periodic internal audits.

5. Modernize and Maintain Your Accounting System

Accounting systems should evolve with your Municipalities’ needs. An outdated or misconfigured system can lead to costly errors and reporting issues. Ensure your system:

-

- Has an updated Chart of Accounts aligned to the Unified Chart of Accounts.

- Is reconciled and closed monthly.

- Can generate budget-to-actual reports for each fund.

If needed, consider migrating to cloud-based solutions like QuickBooks Online, which offer updated features and better access controls. Remember, accounting software is not one-size-fits-all, so choose the tool that fits your Municipalities’ needs.

6. Foster a Culture of Audit Readiness

Audit success isn’t only about systems and spreadsheets; it’s also about communication and continuous improvement by:

-

- Training staff on GAAP, GASB, and regulatory updates.

- Holding pre-audit planning meetings and regular check-ins with your audit firm.

- Conducting a post-audit debrief to discuss findings.

- Address past audit findings proactively, turning them into growth opportunities.

“The best audits happen when there are no surprises. Early communication and openness go a long way.”

What Should You Have Ready for the Audit?

Once your finance team is audit-ready, the next phase is to prepare for the actual audit fieldwork. Being organized and knowing what your auditors will request can make a significant difference.

Municipalities should be ready to provide a wide range of documents/schedules including:

-

- Trial balances and general ledger detail for all funds

- Bank statements, reconciliations, and outstanding check listings

- Capital asset listings and supporting documentation for acquisitions, disposals, and depreciation

- Debt schedules, including supporting loan or bond agreements

- Grant schedules, with documentation of expenditures and compliance requirements

- Budget-to-actual reports and explanations for significant variances

- Revenue and expense support, including invoices, receipts, and contracts

- Payroll registers and benefits reconciliations

- Legal and contingent liability disclosures from attorneys

- Copies of all meeting minutes, policy manuals, and key internal control procedures

Auditors may also request access to your accounting software, internal control documentation, and prior-year audit findings with evidence of corrective actions taken.

“The easier it is for us to trace financial activity back to clear, well-organized documentation, the smoother the audit goes for everyone.”

Final Thoughts:

Audit readiness isn’t about perfection; it’s about being proactive. A well-managed audit process demonstrates your city’s commitment to good governance, financial transparency, and responsibility of taxpayer funds. As the audit season approaches, remember to start early, stay organized, and keep the lines of communication open with your auditors.

For more questions about audit readiness, you can contact us online, or you can call us at 1-770-495-9077 or email us at [email protected].

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.

1. Organized and Accessible Documentation

1. Organized and Accessible Documentation