The Importance of Cash Flow Statements

- May 12, 2025

- Posted by: CKH Group

- Category: Financial Tips

Cash Flow Statements: What They Are and Why They Matter More Than You Think

When it comes to business health, people often point to profit, if not their revenue. They see how many sales they’ve made, their contract amounts, and celebrate their wins. But here’s the truth: You can’t spend profit. You can only spend cash; the actual money you have available at any given time.

That’s why the cash flow statement might be the most critical part of your financials, even over income statements, especially when making business decisions, advising clients, or simply staying in business.

As the saying goes:

“Revenue is vanity, profit is sanity, cash is reality.”

What’s the difference between the income statement and cash flow statement?

The income statement and the cash flow statement serve two very different purposes, even though they’re often confused.

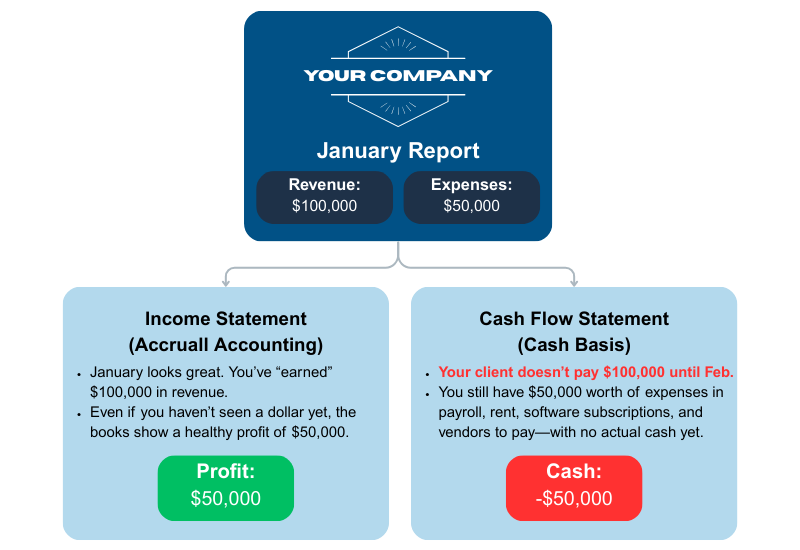

The income statement shows a company’s profitability over a specific period—revenue earned and expenses incurred—regardless of when cash actually changes hands. It follows the accrual basis of accounting, meaning a business can report high profits even if it hasn’t collected payments yet. The cash flow statement, on the other hand, shows the actual movement of cash in and out of the business. It reveals how much money you truly have available to spend.

-

- The income statement tells you how much you’ve earned.

- The cash flow statement tells you how much you’ve got.

They complement each other, but the cash flow statement is what tells you if you can afford tomorrow.

Profit vs. Cash Flow: A Quick Real-World Example

Let’s say your company lands a massive $100,000 contract in January. You do the work that same month, send the invoice, and record the income. In the month of January, you’ve projected $50,000 in spending costs. Leaving you with a cool $50,000 in profit.

So while your income statement says “winning,” the reality is that you now have a month’s worth of expenses without any cash to pay it. That’s the difference. And it’s a big one. Poor collection practices, high upfront costs, or overexpansion can drain your cash long before you run out of revenue.

What Is a Cash Flow Statement?

A cash flow statement tracks all the real money that came in and went out during a specific period. It’s divided into three sections:

-

- Operating activities: Day-to-day business cash—receipts from customers, payments to suppliers, salaries, rent, etc.

- Investing activities: Buying or selling assets—like equipment, property, or investments.

- Financing activities: Borrowing money, issuing shares, repaying loans, or paying dividends.

Add them together, and you see your net change in cash, or what’s actually left in your account at the end of the period.

How Is a Cash Flow Statement Prepared?

There are two ways to build a cash flow statement:

1. Direct Method

This approach lists actual cash received and paid during the period:

-

- Money in from customers

- Money out for rent, salaries, supplies, etc.

It’s straightforward and intuitive like checking your bank statement.

2. Indirect Method

This is more common in formal reporting and required under US GAAP (accrual basis of accounting).

It starts with net income from the income statement, then adjusts for:

-

- Non-cash expenses (like depreciation)

- Non-cash income (like fair value adjustments)

- Changes in working capital (like inventory or receivables)

Bottom line:

Both methods end up at the same number. One starts with reality (direct), the other starts with accounting theory (indirect).

How to Improve Cash Flow

Improving cash flow doesn’t always mean cutting costs, it’s about getting smarter with timing, structure, and planning. Here are some of the most effective, actionable strategies:

-

- Get paid faster. Speeding up your receivables is one of the easiest ways to free up cash. Send invoices immediately, shorten payment terms where you can, and follow up consistently. Offer discounts for early payment if it makes sense for your margins.

- Delay cash going out. Renegotiate payment terms with your suppliers. See if you can push due dates without straining relationships. Every extra day your money stays in your account helps.

- Keep inventory lean. Overstocking ties up cash in products sitting on shelves. Implement just-in-time practices where feasible, or track which items move slowest and adjust your ordering.

- Revisit recurring expenses. Audit your subscriptions and monthly commitments. Are you still using every tool or service you’re paying for? Can you downgrade any plans?

- Lease, don’t buy. If you need equipment or vehicles, consider leasing instead of purchasing outright. It reduces the upfront cash burden and keeps funds available for other needs.

- Forecast regularly. Create a 3-, 6-, or 12-month cash forecast based on realistic inflows and outflows. It’s easier to prevent a cash crunch when you see it coming weeks ahead.

- Build a buffer. When times are good, don’t let your cash just sit. Set aside a working capital reserve for seasonal downturns or unexpected delays in customer payments.

These strategies aren’t just about staying afloat, they’re about regaining control. And if you’re not sure where to start, a cash flow review with your accountant or advisory partner (like CKH Group) can shine a light on hidden leaks or missed opportunities.

Monitoring Cash Flow in Real Time

For modern businesses that want to be diligent in staying on top of their cashflow, they can use cash flow dashboards that pull real-time data from their accounting systems (like QuickBooks, Xero, or SAP).

These dashboards can track:

-

- Cash on hand

- Burn rate (how fast you’re spending)

- Receivables aging (how long clients are taking to pay)

- Payables due (who you owe and when)

- Solvency runway (how long your cash will last at current pace)

CKH Group offers custom dashboards as part of our Data Analysis & Visualization services – especially to our clients who we already provide accounting solutions for and have access to their accounting systems. Whether you’re a business owner or CFO, we help you see your cash reality at a glance so you can make better decisions, faster.

Final Thoughts

Cash flow isn’t just an accounting term—it’s the heartbeat of your business.

You don’t need to be a CPA to understand it, but you might need a CPA help you improve it.

If your business is profitable but you’re still losing sleep, it might be time to look at your cash flow, not your income statement.

Cash is reality. And if you master your cash flow, you don’t just survive, you thrive.

To learn more about how CKH Group can help you with your cash flow statements, connect with us online or reach out to us directly at 1-770-495-9077 or email us at [email protected]

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.