Negotiate Transactions

Confidently

with a reliable

QoE Report

Discover a business’s true profitability and negotiate for better purchase terms with the help of trusted insights from a Quality of Earnings Report.

What are our clients saying?

President/CEO

“We at the Cochran-Bleckley Chamber of Commerce have had an amazing experience working with the CKH Group located in Hawkinsville, Georgia. Kyle and Lyndsay work with us one on one in setting our Quickbooks up where it is fully accurate and efficient and have assisted us in working through financial questions and concerns. I cannot recommend them enough. From quick email responses, actually answering and returning phone calls to being physically present in the office to meet and touch base with us, their service, performance and expertise are unmatched!”

Clerk to the Commission

“Just wanted to say how much I enjoyed working with CKH Group. I wanted to especially give a shout out to Stephné Kukard, who handled much of the day-to-day interface with Telfair County and is definitely an asset for CKH Group. I am also applauding Eon Van Wyck and Roger Nixon. The CKH representatives’ professionalism, efficiency, and helpfulness, among other positive attributes, were much appreciated by Telfair County. I especially welcomed how efficient and timely their responses were to our emails and telephone calls, along with CKH’s business-friendly approach, attention to detail, and kindness.”

Programs Administrator

“Telfair County’s transition to CKH Groups was seamless. The professionals who served us were objective, experienced, and responsive in performing our audit services, including our compliance and single audits. We would highly recommend their team.”

Long Term Client

“Outstanding service from Yvette and Frank for many years! Thank you from the Anthony family.”

City Clerk

CKH’s responsiveness has been excellent. Anything I’ve needed they respond back immediately. They do an awesome job, and there’s so much I’ve got going on that was impossible to do by myself, so CKH has been an incredible help. I feel confident in CKH, like a weight has been lifted off my shoulders. I have been very pleased with CKH Group.

Tax Supervisor

I am so thankful for CKH Group’s staff. They are absolutely rocking it! They are so smart and such quick learners. CKH Group accountants have been doing things in the few short weeks that some haven’t done after even a year. I am so impressed with the time and effort they have put in to quickly learn our business. CKH Group has really nailed it with these employees. I am so appreciative, thank you!

Corporate Manager

CKH is worth every penny! I sincerely appreciate CKH Group; you guys continue to impress me, and I have so enjoyed this partnership. I couldn’t do it without you all!

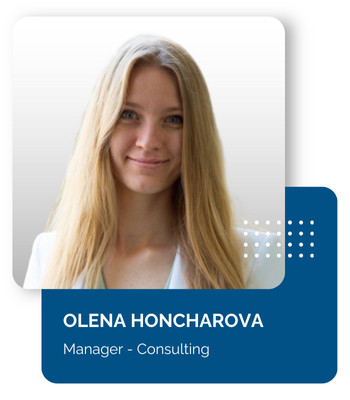

Our Quality of Earnings Manager Olena Honcharova holds a master’s degree in corporate finance and has a wealth of knowledge in business valuations, financial due diligence, and QoE reports. In her current role she engages with both buy-side and sell-side transactions and is dedicated to maximizing client value during M&A activity.

1. What is in a Quality of Earnings Report?

A quality of earnings report is a detailed financial review (usually around 30 pages) that highlights a company’s true profitability. It includes adjusted EBITDA, working capital, customer and vendor concentration, and other key insights like aging analysis and product-level margins.

2. How is a QoE report different from other due diligence?

A QoE report focuses specifically on financial due diligence. Unlike audits or basic financial reviews, it digs into anomalies and adjustments that reveal how much profit and cash flow the business really generates. Even if a company passes an audit, a QoE can uncover hidden risks.

3. Why choose CKH Group?

At CKH Group, we bring together precision, speed, and deep financial expertise. As a full-service CPA firm, we offer a level of technical accuracy and insight that many other due diligence providers can’t match. Our team delivers thorough, customized reports quickly without compromising on quality. We’re also deeply client-focused, and your success drives everything we do. That’s why we aim to give you the clarity and leverage needed to make smart investments and negotiate with confidence.

4. How much does it cost?

Costs typically range from an estimated $12K to $100K+, depending on company size and complexity. We offer flexible payment terms and can send you a free quote within 24 hours after reviewing basic financials (Balance Sheet, P&L, and accounting software details). For more accurate pricing, contact us for more details.

5. How long does it take to prepare?

We understand that time is of the essence, and no one wants delays in the transaction process due to hang ups during due diligence. That’s why we have a large, experienced team ready to begin immediately. For a small to mid-sized company, we can deliver the report within an estimated 12 to 22 business days from the date all necessary information is received. For a more accurate time range tailored to your specific businesses, please reach out for more details.