Reliable Month-End Close for Local Governments

- September 26, 2025

- Posted by: CKH Group

- Categories: Articles, Government Accounting

The Basics of the Month-End Close for Local Governments: Bank Reconciliations and Payroll Reporting

This article is adapted from CKH Group’s CPE-accredited course, “Monthly Accounting 101: The Basics of the Month-End Close for Local Governments.” Reading this article is not eligible for CPE credit.

At CKH Group, our mission has always been to support the communities we serve; not just through providing accounting services, but by equipping local leaders with the knowledge and tools they need to succeed. Local governments carry an enormous responsibility: protecting taxpayer funds, ensuring accurate reporting, and making financial decisions that affect entire communities. We believe that by strengthening financial processes, we help strengthen communities themselves.

It’s with that goal in mind that we hosted our CPE course, Monthly Accounting 101 – The Basics of the Month-End Close for Local Governments. The session focused on two of the most critical components of municipal accounting: bank reconciliations and payroll reporting. We’ve homed in on these topics due to how important correct and accurate reporting and documentation is for annual financial audits – which are necessary to receive certain state and federal grants and funding.

In this article, we’ve distilled the core training into a practical guide. We’ll walk through why reconciliations matter, how to approach them effectively, and what payroll reporting requires at the local government level. Together, these practices form the backbone of a reliable month-end close.

Bank Reconciliations: Building Trust Through Accuracy

A bank reconciliation compares your government’s internal cash records to the monthly bank statement to make sure every dollar is accounted for. It’s a safeguard that prevents misreporting, detects errors and misuse early, and supports compliance with state requirements (for Georgia entities, this work underpins accurate budget and financial reporting under OCGA § 36-81). Done monthly (or weekly!), it keeps the cash number decision-makers rely on both current and credible.

For example, it could catch a duplicated $25,000 grant receipt before it reaches council- which protects the budget and the clerk’s reputation.

How to perform a bank reconciliation

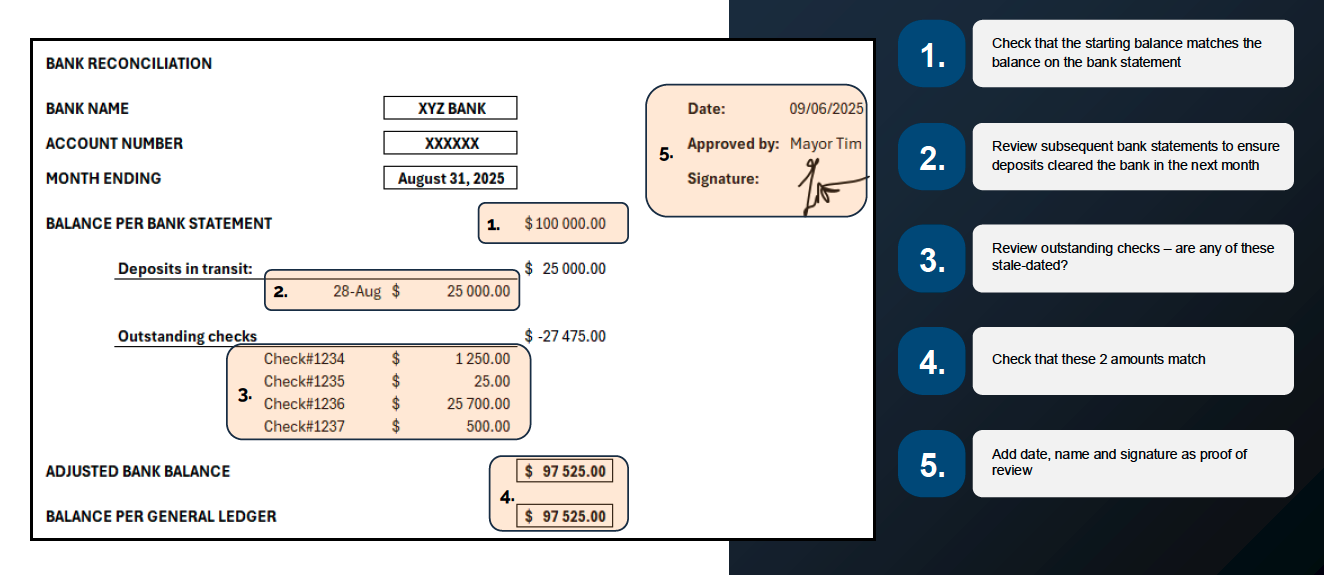

- Confirm your starting point. Before you begin, make sure last month’s reconciliation tied the ledger to the bank and that the opening balance in your software matches the prior month’s adjusted balance. If the opening is off, fix that first.

- Gather source records. Pull the full bank statement, general ledger cash detail, cash receipts journal, check register, and (if applicable) payroll and loan schedules. This is your independent evidence set.

- Tick-and-tie activity. Compare each bank statement line to your ledger. Check off matches; flag items on the statement that aren’t in the books (add them) and items in the books that haven’t cleared (timing differences).

- List reconciling items. Create schedules for deposits in transit and outstanding checks (include dates and check numbers). Monitor these so deposits clear next month and stale-dated checks get followed up.

- Correct mis-postings properly. If an item should have flowed through a module (AP, cash receipts, payroll), fix it in the module so it posts to the GL and the reconciliation tool. If that’s not possible (e.g., external payroll), book a journal entry with clear descriptions and supporting docs. Reverse the error, then post the correct entry to preserve an audit trail.

- Prepare the reconciliation report. Include the account and month, bank statement ending balance, reconciling items, and the adjusted (true) cash balance that ties to the GL. Attach supporting schedules.

- Review and sign off. A finance director, mayor, or council member should review the packet and sign/date it. Consider rotating reviewers or adding periodic independent spot checks for smaller staffs.

- File and follow up. Retain the full packet (statement, worksheet, support) and clear the prior month’s reconciling items in the next cycle. Reconcile monthly at minimum; larger entities may benefit from weekly cycles.

For reference, here is an example of a bank reconciliation report and the steps to be taken:

Bank Reconciliation for Audit Readiness

Strong process and documentation are what make reconciliations audit-ready. Auditors will request your last reconciled bank statement, documentation of reconciling items, and written polices on bank reconciliation. So, it is important to maintain the reconciliation worksheet, the full bank statement, canceled checks, deposit slips, and support for any adjustments.

Additionally, having strong internal controls and segregation of duties is critical to reduce audit findings. Ensure every reconciliation is prepared and reviewed (with signatures and dates) to preserve segregation of duties. In smaller governments where one person wears many hats, rotate oversight among members of the governing body or ask your CPA for periodic spot checks to add a low-cost control.

Payroll Reporting: Compliance that Protects Communities

Local governments with W-2 employes must run payroll, which means they must withhold federal and state taxes, remit them on schedule, and report them quarterly. Skipping steps or missing deadlines can trigger penalties, interest, liens or levies, and, in willful cases, felony exposure for responsible parties. But a step often overlooked is accurate payroll reporting.

Each quarter you’ll file three returns: Form 941 to the IRS for federal withholding, Social Security, and Medicare; your state withholding return (e.g., Georgia G-7); and your state unemployment return (e.g., Georgia DOL-4N). Not filing the required returns can result in significant penalties and interest.

How to complete and file Form 941:

- Assemble inputs. Export your quarterly payroll summary from your system (e.g., Edmunds, QS1, or QuickBooks) and gather your IRS payment history (EFTPS download or check register). You’ll use these to reconcile totals.

- Complete the header and Lines 1–3. Enter the number of employees paid this quarter (Line 1), total gross wages (Line 2, before any deductions), and total federal income tax withheld (Line 3).

- Calculate Social Security and Medicare (Section 5).

• Line 5a: taxable Social Security wages × 12.4% (6.2% employee + 6.2% employer).

• Line 5c: taxable Medicare wages × 2.9% (1.45% employee + 1.45% employer).

These lines reflect both employee and employer portions. - Sum total taxes (Line 12). This is federal withholding plus the combined (employee + employer) Social Security and Medicare from Section 5.

- Enter deposits made (Line 13). Total your IRS tax payments already made during the quarter (from EFTPS or checks).

- Determine balance or overpayment (Lines 14–15).

• If deposits < total tax, Line 14 is the balance due: remit via EFTPS or check with a 941-V voucher.

• If deposits > total tax, Line 15 shows the overpayment: apply to next quarter or request a refund. - Sign and date Page 2 (Part 5). The preparer signs, prints name/title, dates, and provides a contact number so the IRS knows whom to reach.

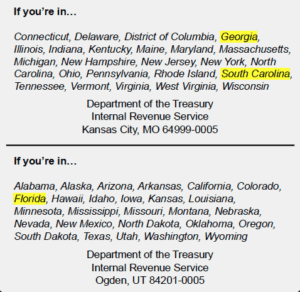

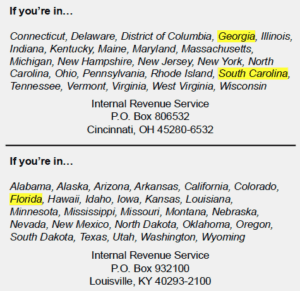

- File electronically or mail by state-specific address. You may e-file, or mail a paper return.

• Without a payment: Mail to Kansas City, MO or Ogden, UT depending on your state.

• With a payment: Mail to the IRS lockbox in Cincinnati, OH or Louisville, KY, again depending on your state. Include the 941-V voucher and a check memo that clearly lists EIN, form, and period. (Addresses vary by state; use the IRS state groupings shown below.)

- Retain your records. Keep the filed return, EFTPS confirmations (or voucher/check copy), and the payroll summary used to prepare the form. Tie everything out before quarter-end next time to avoid last-minute surprises.

Payroll Reporting for Audit Readiness

In the training, we focused on the Form 941 because this report is used by accountants to reconcile to make sure all payments were made. Reconciling your payroll summary to EFTPS (or check) payment history ensures what you withheld is exactly what you paid over. (As of July 1, Georgia’s DOL requires online filings except under special circumstances.)

Be sure to keep copies of returns, payment confirmations, and reports—electronic portals like FTPS, GTC, and SC DOR make audits and internal reviews far easier.

Conclusion

Consistent, careful bank reconciliation and payroll reporting is exactly what keeps communities confident in their local government and audit-ready. That’s the standard we want to help you meet. If you’d like hands-on help streamlining your process or setting up tools that reduce manual work (from bank feeds to reconciliation modules), our team is glad to partner with you. Stronger processes mean stronger communities, one month-end close at a time

Curious about upcoming CPE courses? Keep tabs on our CPE programs, or sign up for our monthly newsletter.

If you have any additional questions, reach out and let’s chat. You can contact us online, or you can call us at 1-770-495-9077 or email us at [email protected].

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents, we will not be held accountable for any changes that are beyond our control.