Late Tax Filing: What To Do if You Miss a Tax Deadline

- May 25, 2022

- Posted by: CKH Group

- Category: Tax tips

How To Navigate Late Tax Filing

So you missed the tax deadline. We get it, life happens, and sometimes filing on time isn’t possible. While there is likely to be some consequences, understanding the steps you can take after a late tax filing can help to minimize the impact. Whether you’re owed a refund or have taxes due, taking swift action can save you from unnecessary penalties and stress.

What to Do If You Miss the Tax Filing Deadline

If you’ve missed the deadline, the first thing to know is that you’re not alone. Many people find themselves in this situation, and while it’s not ideal, there are steps you can take to rectify it. The IRS allows taxpayers to file for an extension, giving them more time to complete their returns. However, this extension is only available up until the original filing deadline, so if you know you’ll have trouble filing on time, be sure to file an exemption. If you’ve missed this date and haven’t filed for an extension, you’ll need to act quickly to avoid further complications.

Filing for an Extension: What You Need to Know

If you ARE still within the window to file for an extension, it’s crucial to do so as soon as possible. Filing an extension can give you up to six more months to complete your return, pushing your deadline to mid-October. This additional time can be invaluable, especially if you’re dealing with complex financial situations or unexpected life events that have delayed your filing.

However, it’s important to note that an extension to file does not extend the time you have to pay any taxes owed. If you suspect that you’ll owe taxes, you should estimate the amount and pay it by the original deadline to avoid interest and penalties. Even if you can’t pay the full amount, paying as much as possible can reduce the penalties you’ll incur.

And no, there isn’t an extension to the extension! If you miss your extended deadline as well, the following information will help you navigate this late tax filing.

What Happens If You’re Due a Refund?

For those who are due a refund, the situation is less dire. The IRS doesn’t impose a penalty for late filing if you’re owed money. Essentially, the government is content to hold onto your refund interest-free until you file your return. You have up to three years from the original filing deadline to submit your return and claim your refund.

However, it’s not advisable to delay filing for too long. Failing to file your return could jeopardize your refund, and after the three-year window, you’ll forfeit your right to claim it altogether. Therefore, even if you’re not facing penalties, it’s still in your best interest to file as soon as possible.

Owing Taxes and Missing the Deadline: Late Filing Penalties

If you owe taxes and missed the filing deadline, the consequences are more severe. Unfortunately, once the deadline has passed, you can no longer file for an extension. This means you’re immediately subject to penalties for both failure to file and failure to pay.

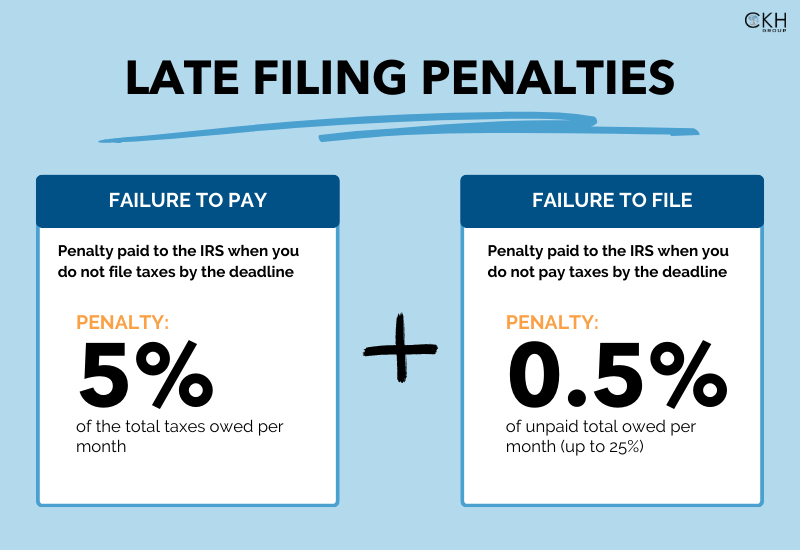

The failure-to-file penalty is typically 5% of the unpaid taxes for each month (or part of a month) that your return is late, up to a maximum of 25%. If your return is more than 60 days late, the minimum penalty is $435 or 100% of the unpaid tax, whichever is less. This can add up quickly, making it crucial to file your return as soon as possible.

In addition to the failure-to-file penalty, you’ll also incur a failure-to-pay penalty. This penalty is generally 0.5% of the unpaid taxes for each month (or part of a month) that the taxes remain unpaid, also up to a maximum of 25%. The IRS charges interest on unpaid taxes, which accumulates until the balance is paid in full.

Taking Action: File as Soon as Possible

The best course of action if you’ve missed the tax filing deadline is to file your return as soon as you can. Every day that you delay increases the penalties and interest that you’ll owe. The sooner you file, the less you’ll have to pay in the long run.

If you’re feeling overwhelmed by the process or unsure how to proceed, seeking professional help can make a significant difference. Tax professionals, like those at CKH Group, are well-versed in navigating late tax filings and can guide you through the process to ensure you’re compliant with IRS regulations.

How CKH Group Can Assist You

At CKH Group, we understand that life’s complexities can sometimes interfere with timely tax filing. Our team of experienced tax professionals is here to help you navigate the challenges of late tax filing, minimizing penalties, and ensuring that your return is filed accurately. Whether you need assistance with calculating penalties, catching up with multiple year’s returns, negotiating with the IRS, or simply completing your return, we’re here to provide the support you need.

Don’t let the stress of late tax filing overwhelm you. Reach out to CKH Group today for a free consultation, and let us help you get back on track. You can contact us at [email protected] or give us a call at (770) 495-9077. Taking prompt action now can save you money and give you peace of mind.

The above article only intends to provide general financial information and is based on open-source facts, it is not designed to provide specific advice or recommendations for any individual. It does not give personalized tax, financial, or other business and professional advice. Before taking any form of action, you should consult a financial professional who understands your particular situation. CKH Group will not be held liable for any harm/errors/claims arising from the articles. Whilst every effort has been taken to ensure the accuracy of the contents we will not be held accountable for any changes that are beyond our control.